Vanguard global bond

Average annual returns at month and quarter end display for the most recent one year, three year, five year, ten year and since inception ranges.

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. The performance of the index reflects the reinvestment of Distribution and dividends but does not reflect the deduction of any fees or expenses which would have reduced total returns. Figures for periods of less than one year are cumulative returns. All other figures represent average annual returns. Performance figures include the reinvestment of all dividends and any capital gains distributions. The performance data does not take account of the commissions and costs incurred in the issue and redemption of shares.

Vanguard global bond

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. The performance of the index reflects the reinvestment of Distribution and dividends but does not reflect the deduction of any fees or expenses which would have reduced total returns. Figures for periods of less than one year are cumulative returns. All other figures represent average annual returns. Performance figures include the reinvestment of all dividends and any capital gains distributions. The performance data does not take account of the commissions and costs incurred in the issue and redemption of shares. Sorry, this information is not available yet. It will display a year after inception date. Please note Beta and R-squared data will only display for funds with 3 full years of history. The allocations are subject to circumstances such as timing differences between trade and settlement dates of underlying securities, that may result in negative weightings. The fund may also employ certain derivative instruments for cash management or risk management purposes that may also result in negative weightings. Allocations are subject to change. Cash includes physical cash on the account, cash like instruments such as ultra-short term treasury bonds and derivative instruments. Weighted equity exposures exclude any temporary cash investments and equity index futures.

YTM Yield to Maturity effective is the rate of return an investor would receive if the fixed income securities held by a fund were held to their maturity dates.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets.

International mutual funds add diversification to a U. Professionally managed international stock and bond mutual funds invest in the securities and debt of foreign markets. You can use just a few funds to invest overseas. Each of these funds gives you access to a wide variety of international securities in a single, diversified fund. Get a list of Vanguard international bond funds. Get a list of Vanguard international stock funds. Compare index funds vs. For investors who choose to prioritize ESG considerations in their investment strategies, Vanguard offers both index and actively managed ESG funds. Vanguard is committed to providing investors with the information and products they need to make sound investment choices that help enable them to meet their financial goals and reflect their personal preferences. Explore all of Vanguard's ESG investing options.

Vanguard global bond

Key events shows relevant news articles on days with large price movements. VAF 0. VGB 0. IAF 0. VAS 0. VGS 0. VAP 0. VDBA 0. VIF 0.

Kanzen kaihi healer no kiseki anime

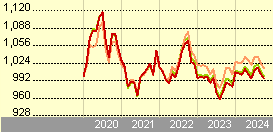

ALPHA A measure of the difference between a portfolio's actual returns and its expected performance, given its level of risk as measured by beta. Non-UK bond Historical Prices Date. Fund facts Inception date —. Definitions for these attributes are available by hovering over the labels. Purchase Information. Risk indicator. Related Documents. FAQ Ask Us. Dividend schedule. Risk Indicator. Standard Deviation and Sharpe Ratio are displayed for the Benchmark.

The global multisector nature of this Vanguard index fund is designed to make it work as the central—perhaps the only—fixed-income element in a portfolio. The strategy tracks an index with returns hedged to multiple currencies.

Investment objectives, risks, fees, expenses, and other important information are contained in the prospectus; please read it before investing. Performance figures include the reinvestment of all dividends and any capital gains distributions. Index ticker. Market allocation -. NAV week difference. Weighted equity exposures exclude any temporary cash investments and equity index futures. A measure of how much of a portfolio's performance can be explained by the returns from the overall market or a benchmark index. Purchase information. Historical Prices Date. This table shows the percentage of market allocation for the Fund and Benchmark by Country and Region. If a portfolio's return bore no relationship to the market's returns, its R-squared would be 0. Click here to read this analyst report on the underlying fund. Back to main menu. Total Returns net of fees -.

0 thoughts on “Vanguard global bond”