Vanguard net worth

Largest Vanguard investment funds worldwide in Septemberby net assets.

Imagine a world in which two asset managers call the shots, in which their wealth exceeds current U. GDP and where almost every hedge fund, government and retiree is a customer. BlackRock Inc. Amassing that sum will likely upend the asset management industry, intensify their ownership of the largest U. None other than Vanguard founder Jack Bogle, widely regarded as the father of the index fund, is raising the prospect that too much money is in too few hands, with BlackRock, Vanguard and State Street Corp.

Vanguard net worth

Vanguard has a fairly unique structure for an investment management company. The company is owned by its funds; the funds are owned by the shareholders. This means that its shareholders are the actual owners. Unlike most publicly-owned investment firms, Therefore, Vanguard has no outside investors other than its shareholders. Vanguard's structure allows the company to charge very low expenses for its funds. Due to its scope, the company has been able to reduce its expenses over the years. The average expense ratio for Vanguard funds was 0. As of the end of , that number stands at 0. Headquartered in Pennsylvania, Vanguard is the largest mutual funds issuer in the world and the second-largest issuer of exchange-traded funds ETFs. It has U.

Tools Tools. One of those is Edward Rock.

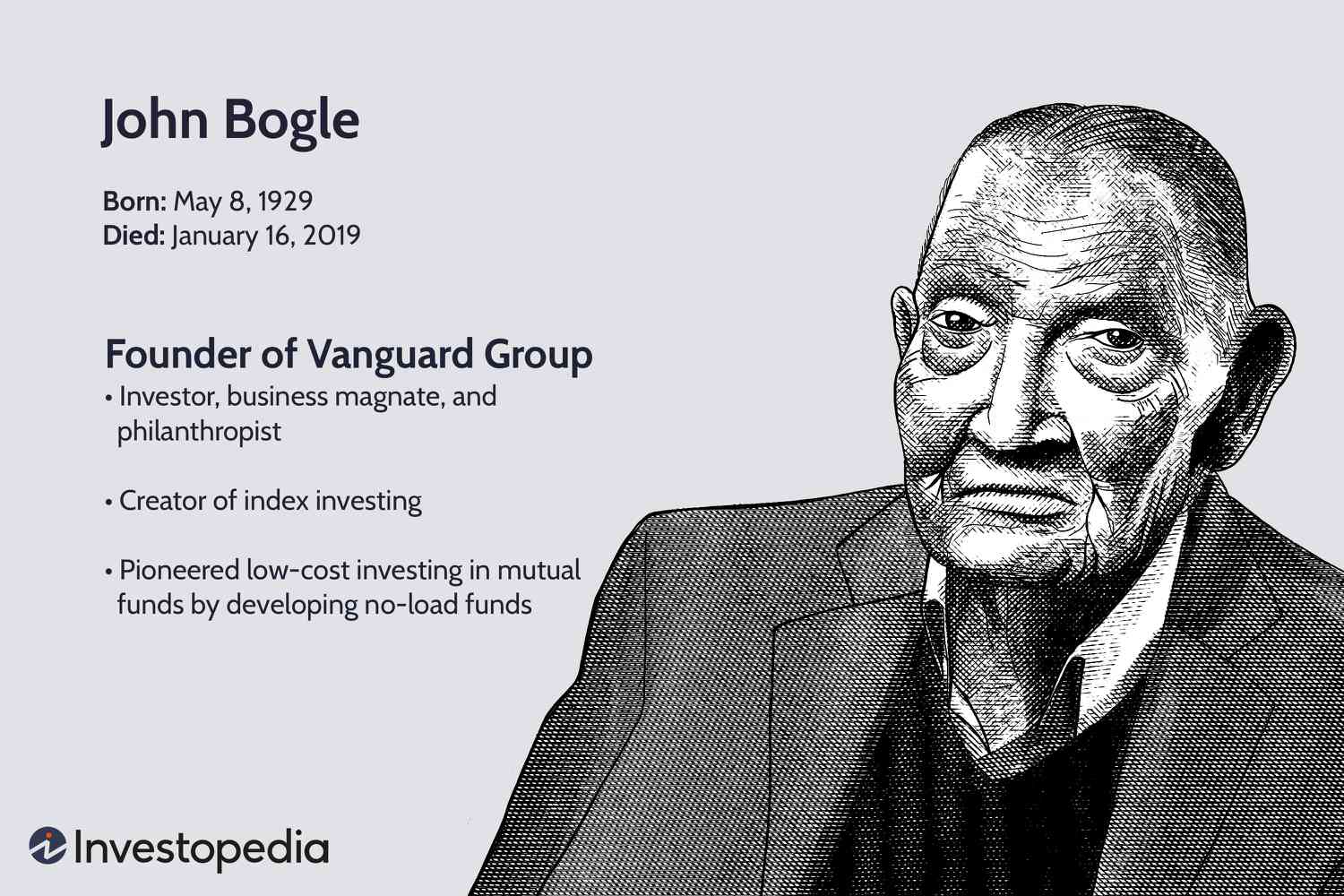

The Vanguard Group, Inc. Several mutual funds managed by Vanguard are ranked at the top of the list of US mutual funds by assets under management. Founder and former chairman John C. Bogle is credited with the creation of the first index fund available to individual investors and was a proponent and major enabler of low-cost investing by individuals, [8] [9] though Rex Sinquefield has also been credited with the first index fund open to the public a few years before Bogle. Vanguard is owned by the funds managed by the company and is therefore owned by its customers. The company also has offices in Canada, Australia, Asia, and Europe.

With great wealth comes more complex, sensitive, and critical needs; we get it. New to Vanguard? Call Monday through Friday, 8 a. An informed investor makes better investment decisions. Vanguard's self-directed option puts you in the driver's seat, allowing you to manage your own portfolio. You'll have a relationship manager whenever you need personalized guidance, and you'll also enjoy other benefits, including:. In addition to the benefits offered with our self-directed option, you'll also enjoy the following:. At Vanguard, you can choose how much assistance you receive.

Vanguard net worth

Chris Flood. Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter. Visit our ETF Hub for investor news and education, market updates and analysis and easy-to-use tools to help you select the right ETFs. It lost some assets after relinquishing a handful of institutional clients in China and Australia. Vanguard and its nearest rival BlackRock dominate the global asset management industry as a result of the massive shift by investors into index-tracking ETFs over the past decade. Analysts predict that BlackRock will have additional inflows in the final quarter of last year when the US stock market hit an all-time high. Vanguard aims replace the Chinese asset losses in time through an investment advisory partnership with Ant Group , a joint venture which has acquired , clients in less than a year. However, complaints have mushroomed across investor bulletin boards about long waiting times to speak to Vanguard advisers and interruptions to services in periods of high market volatility. Click here to visit the ETF Hub.

Nequare vacuum

Fortune Magazine. Vanguard's owners are its funds' shareholders. Related Articles. It is the biggest issuer of mutual funds worldwide and the second-biggest ETF issuer. Forbes Magazine. Categories : The Vanguard Group establishments in Pennsylvania American companies established in Companies based in Chester County, Pennsylvania Exchange-traded funds Financial services companies established in Investment management companies of the United States Mutual funds of the United States Online brokerages Privately held companies based in Pennsylvania Webby Award winners Financial services companies based in Pennsylvania. Learn More. The average expense ratio for Vanguard funds was 0. They must ensure that their holdings generally reflect and track the index's performance. Investopedia does not include all offers available in the marketplace.

He took on the CEO role at the beginning of

Related Articles. Overview Premium Statistic Largest Vanguard investment funds worldwide in September , by net assets Largest Vanguard investment funds worldwide in September , by net assets Leading investment funds owned by Vanguard globally as of September 15, , by net assets under management in billion U. Research Funds. At that rate, Vanguard's portion of the U. Total Net Assets 2. Active managers will be watching these developments closely. This compensation may impact how and where listings appear. Carolina Dulin. These include white papers, government data, original reporting, and interviews with industry experts. May 1, ; 48 years ago Index funds can charge lower fees because, with few exceptions, they track an index that is only changed if a stock listed on the index no longer meets the criteria for being listed. So, Vanguard doesn't own any companies; the fund's shareholders do.

You are not right. I can prove it. Write to me in PM, we will discuss.

I apologise, but, in my opinion, you are mistaken. I suggest it to discuss. Write to me in PM.