Vanguard total bond market index fund ticker

The Fund seeks to track the performance of a broad, market-weighted bond index. The index is the Bloomberg U. Aggregate Float Adjusted Index. This Index measures the performance of a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States, all with maturities of more than 1 year.

The Fund seeks to track the performance of a broad, market-weighted bond index. The index is the Bloomberg U. Aggregate Float Adjusted Index. This Index measures the performance of a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States, all with maturities of more than 1 year. Jack Bogle and Chris Davis agree on many things, but they are at opposite ends of the spectrum when it comes to investing. This browser is no longer supported at MarketWatch.

Vanguard total bond market index fund ticker

.

ET by Brett Arends.

.

Michael Perre is the fund's current manager and has held that role since November of Of course, investors look for strong performance in funds. This fund carries a 5-year annualized total return of 5. Investors who prefer analyzing shorter time frames should look at its 3-year annualized total return of 1. It is important to note that the product's returns may not reflect all its expenses.

Vanguard total bond market index fund ticker

With the launch of two municipal bond ETFs in January , Vanguard now offers four muni ETFs in all, providing low-cost, tax-efficient, and liquid coverage across the muni yield curve. ETFs offer some of the most efficient and flexible access to the muni bond universe. A basis point bps is one-hundredth of a percentage point. After two years of Federal Reserve interest rate increases, the federal funds rate as of this writing is 5. For high-net-worth investors, taxes can erode these attractive yields. Municipal bonds generally offer lower absolute yields, but because their income is exempt from federal and sometimes state taxes, their after-tax yields can often surpass the yields of taxable bonds for investors in the top tax brackets. With markets now shifting to the prospect of future rate cuts, muni investors may be about to capitalize on these higher yields, compared with cash or other short-term savings instruments, while they last. Notes: The municipal tax-equivalent yield is calculated using a Yields on savings accounts and month certificates of deposit are national averages provided by the Federal Deposit Insurance Corporation FDIC as of January 16,

Otter geometric

ET by Andrea Coombes. Access Premium Tools. The index is the Bloomberg U. Search Clear. ET by Ben Carlson. Latest News All Times Eastern scroll up scroll down. Show Funds. Other News. Uh oh Something went wrong while loading Watchlist. ET by Brett Arends. Currency Denominated Bonds 1. Market Data. Symbols Loading This Index measures the performance of a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States, all with maturities of more than 1 year. ET by Robert Powell.

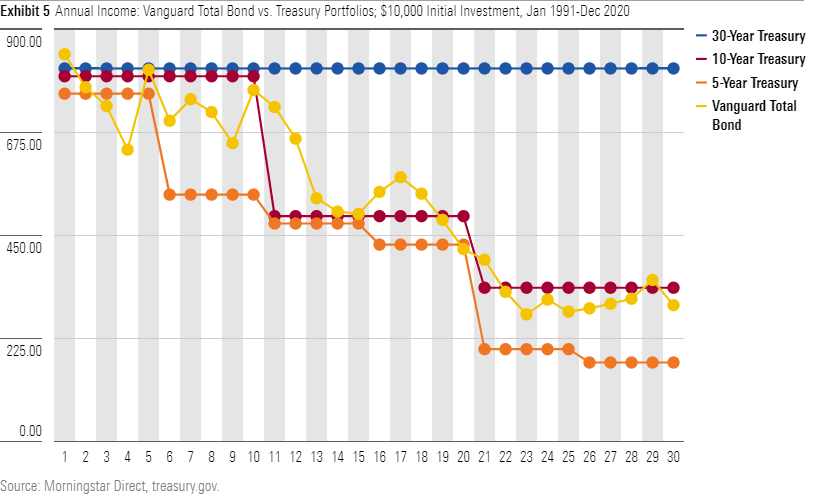

B efore , investors looking to incorporate bonds into their portfolios faced limited and often challenging options. They could directly purchase bonds over the counter, entrust the selection to a financial advisor or invest in an actively managed bond mutual fund.

Search Tickers. ET by Howard Gold. Aggregate Float Adjusted Index. Search Clear. Compare: Returns Risk Fees Holdings. Aggregate Float Adjusted Index. MarketWatch Dow Jones. ET by Chana R. All News Articles Video Podcasts. FTSE

In it something is. Thanks for an explanation.

I against.