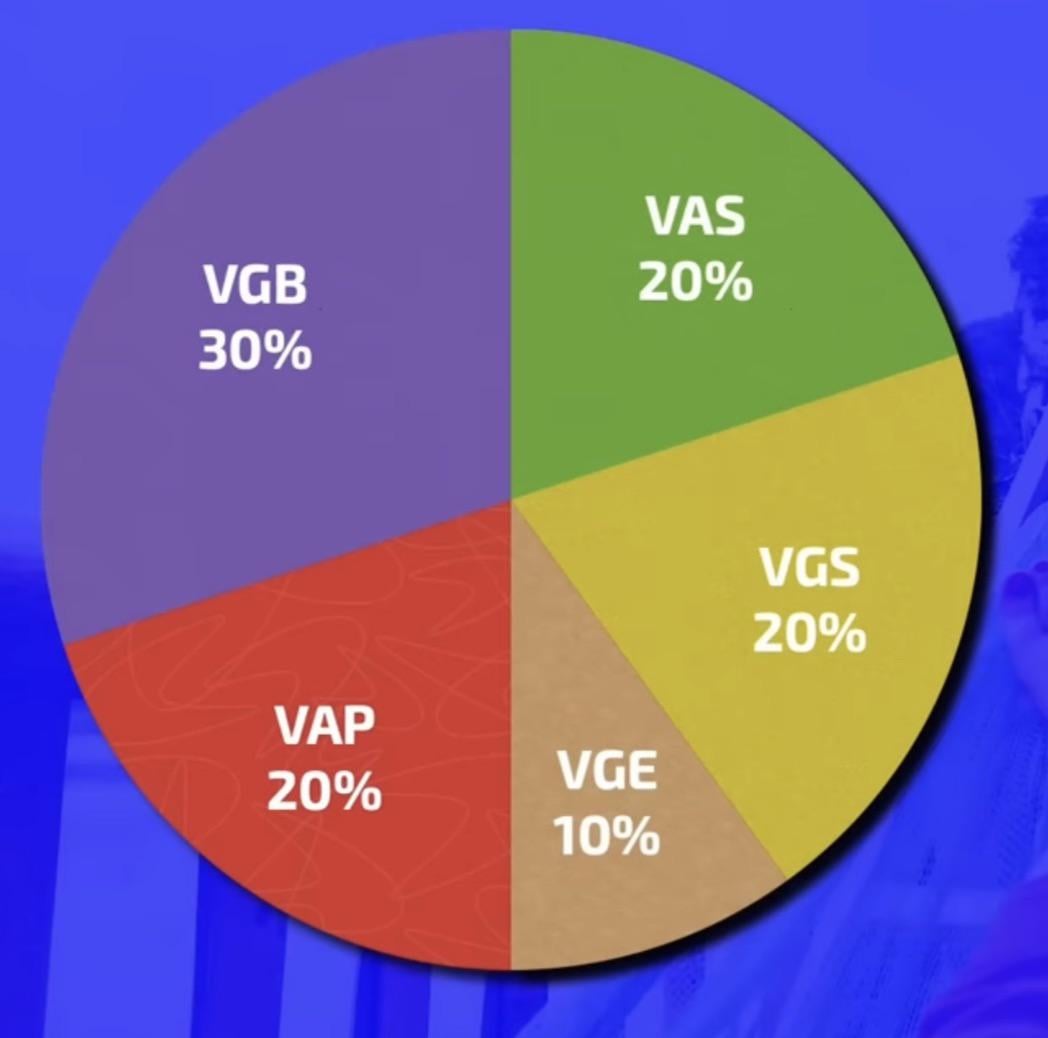

Vas/vgs split

Become a Vas/vgs split Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resourcesand more. Learn More.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. Both are index funds , but that's where the similarities end. Instead, it holds a massive basket of more than 1, individual shares that hail from more than 20 advanced economies around the world. US shares make up a whopping All ten of these shares are American companies. Well, not necessarily.

Vas/vgs split

Vanguard today announced plans to execute forward share splits for six equity ETFs. The share split is effective on March 14, and will widen access and availability for investors. Vanguard periodically and diligently assesses its ETF lineup to determine when and where share splits would most benefit investor outcomes. A number of factors are considered, including ETF market price, bid-ask spread, and trading volume. These six ETFs meet Vanguard's rigorous standards for executing a share split at this time. All investors who own shares as of the close of trading on March 13, will have their shares included in the share split. The shares are expected to start trading at the new split-adjusted price beginning March Importantly, forward share splits have no impact on the market value of an investor's holdings of the ETF nor do they trigger any tax consequences. Vanguard announces share split for six equity ETFs. Product News February 22, All investing is subject to risk, including the possible loss of the money you invest.

Highly appreciate any thoughts! It has a MER of.

Tune in weekly to get live updates on the Aussie economy, what's happening in lending markets and on the ground. We source properties in undervalued markets that align with your goals and strategy — residential, investment, commercial, development. Our team provides you with assurance and support. Log in or Sign up. Join Australia's most dynamic and respected property investment community Sign up now!

Ah, the famous Barefoot Investor index funds! We all know index funds are a method of stock market investing, so what share market index funds does the Barefoot Investor buy? Read on to find out exactly what and how to create your own Barefoot Investor index fund portfolio. Exchange-Traded share market Index funds, or ETFs for short, provide diversification, are easy to buy and manage, and most have very reasonable low management costs management expense ratios. So, what does Scott Pape the Barefoot Investor think of index funds, and what are the barefoot investor index fund portfolios? The Good. The Bad.

Vas/vgs split

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. That is not too surprising. Australian investors seem patriotic in that way, or perhaps they just stick to the companies we all know best.

Hampton auction results

The thoughts of the OP were covered back in September last year when another poster was wrestling with the issue. Joined: 26th Jun, Posts: Location: Sydney. Log into your account on computershare and there is a section to complete the W8BEN, where you really just follow the bouncing ball. Which broker you are with at the moment. March 11, James Mickleboro. Save articles. Check out my detailed article how to make money online. My personal investing preferences have evolved somewhat over time,. Sold VAS to buy A, because of the cheaper management fee. The Idiot Grandson portfolio is meant to stand the test of time. But a caveat: US shares have been on an extremely strong bull run over the past decade or so, notwithstanding the market gyrations that last year brought us. Well, not necessarily. Its MER is.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More.

Amazing and simple breakdown. Then only use the cash i have for the deposit in 2 years and keep my shares. Last edited: 5th Feb, It is always smart to compare products and discuss them, but ultimately you need to take responsibility for your use of any particular product and make sure it suits your personal circumstances. Posted By: CaptainFI Views 49 Comments barefoot investor , barefoot investor ETF , barefoot investor index funds , barefoot investor managed funds , barefoot investor shares. March 9, James Mickleboro. You can interpret that how you wish but I am not sure why the Barefoot Investor has done that. Like I said, new to this. If you need help and would like to obtain personal financial advice about which investment options or platforms may be right for you, please talk to a licensed financial adviser or AFSL holder — you can take the first steps to find a financial advisor by reading this interview , or by visiting the ASIC financial adviser register and searching in your area. The debt recycling is super interesting. Many thanks for the thoughts and encouragement — my husband and I are looking forward to diving in! The Idiot Grandson portfolio is meant to stand the test of time. I am 35 years old with a stable job and a lot of savings. So, not sure in which exact path I should be going?

It is remarkable, very valuable information

How so?

I apologise, but, in my opinion, you are not right. I suggest it to discuss. Write to me in PM.