Vdhg review

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resourcesand more, vdhg review.

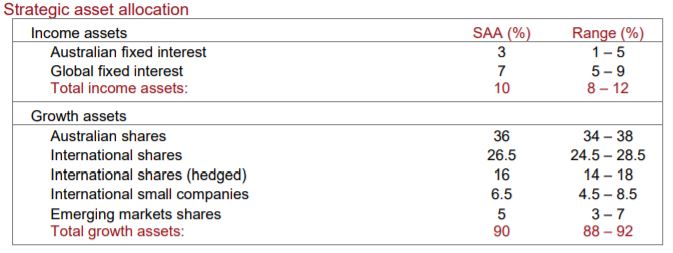

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. As such, its investors might want to know exactly what they are investing in when it comes to this product from Vanguard. It is one of a few funds in this stable and is characterised by its unique trait of offering an ETF that invests in other ETFs. Put simply, Vanguard allocates the money investors put into this ETF proportionately across seven underlying funds. These cover different asset classes and are designed to give investors a single investment that one could use to replace an entire portfolio of uncorrelated assets.

Vdhg review

You can use this chart to visualise how the ETF responds to different market environments. The chart compares price return only. The VDHG ETF invests in a range of other wholesale and retail Vanguard funds, giving investors exposure to both equities and fixed interest securities with a single purchase. The VDHG ETF might be used by investors who are wanting a simple way to establish a diversified portfolio with an aggressive weighting towards growth assets. This ETF may suit investors with a high risk tolerance, a long investment time-frame, and a focus on capital growth over income. Full DRP. Track Record. Diversified ETF. The Best ETFs technical analysis chart pack shows the month share price movements, Stochastic bands and traded volume for both up and down days. Please know that these warnings are based on quantitative metrics and our internal methodology. These risks are not exhaustive and therefore they should not be relied upon.

In all the funds, the equity portion is split the same. The Australian stock market makes up just 2.

In regular conversations, we think of something as risky when there is a chance of a significant and permanent loss. But in the long term, they provide a higher expected return. On the other hand, bonds or fixed-term deposits have almost zero short- or medium-term risk since the capital is returned on maturity. But over the long term, bonds return much less, so even though they have less short term volatility i. A high-growth or high-risk fund is simply a fund with most or all stocks and little or no bonds. So, if you already invest in VAS or VGS and little-to-no bonds or cash, your investment is already high risk or high growth.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. For people who like investing to be as simple as possible, this could do quite well at ticking the box because of the diversification the fund offers. We can invest in just this one ETF and get an allocation to ASX shares, larger international shares, smaller international shares, shares listed in emerging markets, as well as local and global bonds. One could say the percentages of the allocations should be different between the markets, but this is what Vanguard has gone with. To me, it's a good thing the VDHG ETF is largely invested in shares because, over time, I think shares are capable of producing stronger returns than bonds. The VDHG ETF's diversification is so widespread that its returns have probably led to underperformance compared to other ETFs based just on shares that an investor could have gone with.

Vdhg review

Deciding what to invest in is even harder. Stocks, property, or bonds? Apple, Tencent or Pilbara Minerals? Are bonds worthless for young investors? Multi-asset exchanged-traded funds ETFs offer to do all the hard work for investors. These funds blend different growth and defensive asset classes like equities, bonds and cash into a single product by investing in a handful of funds. Funds are constructed to cater for different risk profiles like conservative, balanced and high growth, not dissimilar to products offered by superannuation funds. Simplicity is attractive, and investors have flocked to multi-asset funds. These types of funds have grown in popularity as investors seek an 'all-in-one', low-cost, easily accessible option for the core of their portfolios. However, you take what you get.

Acs omega publication fee

Also, note that the total global equities combined hedged and unhedged is in cap-weighted proportions, which means they have maintained market-priced proportions of large, medium, and small companies in 45 developed and emerging countries — avoiding active management risk of trying to guess which asset classes will do what in the future. The VDHG ETF's diversification is so widespread that its returns have probably led to underperformance compared to other ETFs based just on shares that an investor could have gone with. Our analyst team has put together a full research report and a step-by-step investment guide to buying this ETF. You sell right before Australian equities rise, resulting in a lower return than if you left it alone as you should have. A high-growth or high-risk fund is simply a fund with most or all stocks and little or no bonds. You can use this chart to visualise how the ETF responds to different market environments. Rask Australia. Latest ETF news:. VDHG holdings. Thus, you really are getting a mixture of all different kinds of investments here. And everything in between. Access the PDS. Having Vanguard do this for you becomes a more significant benefit than many realise. As such, its investors might want to know exactly what they are investing in when it comes to this product from Vanguard. Then there are index funds.

Once understanding how VDHG works, it could be a worthy contender.

You get the idea. VDGR Growth. March 11, James Mickleboro. Since ETFs are more tax-efficient, holding the underlying ETFs yourself would be more tax-efficient than holding the all-in-one funds. Twitter Youtube LinkedIn. Diversified ETF sector data. The Best ETFs technical analysis chart pack shows the month share price movements, Stochastic bands and traded volume for both up and down days. The annual management expense ratio MER for the diversified fund is 0. Premium subscriptions. However, the exposure to each is tweaked to tailor each fund to different investment goals. Last 12m yield: 4. March 6, Tristan Harrison. The VDHG ETF invests in a range of other wholesale and retail Vanguard funds, giving investors exposure to both equities and fixed interest securities with a single purchase. Highest yielding ETFs.

Many thanks for the help in this question. I did not know it.

I suggest you to try to look in google.com, and you will find there all answers.

In it something is. Many thanks for an explanation, now I will not commit such error.