Wells fargo auto payoff telephone number

At this time, Wells Fargo Auto loans are only available through dealerships. With a network of nearly 11, dealerships nationwide, be sure to ask the dealership if Wells Fargo Auto financing is available to you. If your loan is funded by Wells Fargo Auto, we'll service your account. With Wells Fargo Online, you'll need to complete a one-time enrollment process.

With automatic payments, your payment is debited monthly from your checking or savings account at no cost. To set up automatic payments, sign on , select your auto loan from Account Summary, and then select Set up Autopay. You can also call us at or download the automatic loan payments authorization PDF , complete the form, and return by mail or fax. Sign on and select your auto loan from Account Summary. You can make a payment immediately or schedule a payment up to 30 days in advance. Enroll now.

Wells fargo auto payoff telephone number

To complete an application, please refer to the Application Checklist. See our current interest rates or check your rate in minutes with no impact to your credit score. Apply when you're ready. For most applications, you can track your application status online if you share your email address with us at the time of application. We'll send you an email telling you how. How do I make a payment? You have many options for making payments. With automatic payments, your payment is debited monthly from your checking or savings account at no cost. To set up automatic payments, sign on , select your auto loan from Account Summary, and then select Set up Autopay. You can also call us at or download the automatic loan payments authorization PDF , complete the form, and return by mail or fax.

Pay by phone Call24 hours a day, 7 days a week, to use our automated system. You can make payments at any Wells Fargo banking location and a Wells Fargo account isn't required. The outstanding loan balance will continue to accrue interest until the loan is paid off.

If you're experiencing financial challenges, or have long-term or more permanent financial difficulties, we may be able to help. If you're unable to make your payment in full, please call us at , and we'll review your account with you to determine next steps. Please keep in mind that if we don't receive the full payment amount by the due date, your account is still considered past due. If changing your payment due date will help your budget and your ability to make payments on time, see How do I change my payment due date? A payment deferment pushes out your due date and extends the loan maturity date. Call us for more information and to see if you're eligible for a deferment. The more we understand about your situation, the better we'll be able to suggest payment options.

At this time, Wells Fargo Auto loans are only available through dealerships. With a network of nearly 11, dealerships nationwide, be sure to ask the dealership if Wells Fargo Auto financing is available to you. If your loan is funded by Wells Fargo Auto, we'll service your account. With Wells Fargo Online, you'll need to complete a one-time enrollment process. You'll need your Social Security number and date of birth to get started. If you have questions or need assistance with the enrollment process, please call us at

Wells fargo auto payoff telephone number

With automatic payments, your payment is debited monthly from your checking or savings account at no cost. To set up automatic payments, sign on , select your auto loan from Account Summary, and then select Set up Autopay. You can also call us at or download the automatic loan payments authorization PDF , complete the form, and return by mail or fax. Sign on and select your auto loan from Account Summary. You can make a payment immediately or schedule a payment up to 30 days in advance. Enroll now. Call , 24 hours a day, 7 days a week, to use our automated system. Make your check or money order payable to Wells Fargo Auto. Be sure to fill in all sections of a money order. Don't send cash.

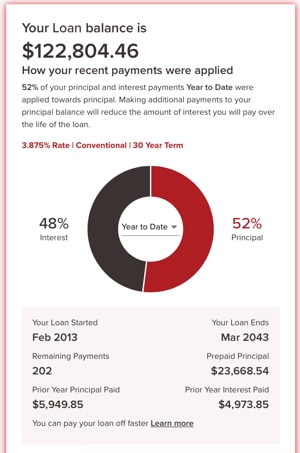

Bbc persian news

Converting an electronic title to a paper title could take at least weeks, depending on the motor vehicle department processing time. Once the account is paid ahead 3 months, additional funds go toward principal only. Note: If you already have the paper title in hand, or are waiting on the motor vehicle department to mail your paper title, you don't need a lien release. Maintenance packages are prepaid plans that typically cover scheduled maintenance, such as oil changes, on the vehicle. Find out how payments are applied to your loan. Your monthly payment amount will remain the same. Phone Call us at to obtain an automated payoff quote or to speak to a representative. Mail your payment to:. Where can I find this information? Be sure to fill in all sections of a money order.

.

With automatic payments, your payment is debited monthly from your checking or savings account at no cost. How do I request authorization to take my vehicle out of the country? What is currently due? If you repossess my vehicle, can I get it back? If you don't designate a payment as principal only, each payment in full equal to your regular payment amount will advance your due date by one month, up to three months. Any additional amount that you paid will be returned to you by check. I have auto insurance and GAP. If you still have questions after you contact the dealership, or if you need a copy of the aftermarket product contract, call us at GAP may not cover late payments, late fees, or deferred payments. This letter lets you know what to do in order to bring your account current — or how to "cure" the default and avoid repossession.

I apologise, but, in my opinion, you are mistaken. Let's discuss it. Write to me in PM, we will communicate.