Wells fargo daily limit withdrawal

You are leaving wellsfargo. Although Wells Fargo has a relationship with this website, Wells Fargo does not provide the products and services on the website. Please review the applicable privacy and security policies and terms and conditions for the website you are visiting.

This summary describes some of the most common fees that may apply to your checking account. Everyday Checking is designed for your day-to-day financial needs, provides convenient banking options, and offers easy access to your money. You can avoid the monthly service fee with one of the following each fee period:. Fees may vary based on the type of account you have because some accounts offer fee waivers for some services. For a complete list of services, fees, and fee waivers that are available with your account, please refer to the Consumer Account Fee and Information Schedule. For each debit card purchase in a foreign currency that a network converts into a U.

Wells fargo daily limit withdrawal

Money Market Accounts. Best High Yield Savings Accounts. Best Checking Accounts. Best Online Banks. Best National Banks. Best Money Market Accounts. Best Premium Checking Accounts. Best Regional Banks. Best Investments. Best Mutual Funds.

Best National Banks.

We can help you find both at Routing Numbers and Account Numbers. Don't have access to Wells Fargo Online? Enroll now. You can request to close your account anytime. We can close most accounts immediately when:. Are there conditions that may prevent closure? When you request closure by phone or in person, we'll inform you if your account has a condition that prevents closure.

You are leaving wellsfargo. Although Wells Fargo has a relationship with this website, Wells Fargo does not provide the products and services on the website. Please review the applicable privacy and security policies and terms and conditions for the website you are visiting. Your card never leaves your hand. Making deposits is easy. The ATM scans your checks, counts your bills, and totals them on the screen. Conveniently transfer funds between your personal or business accounts. You can also make payments to your Wells Fargo Credit Card.

Wells fargo daily limit withdrawal

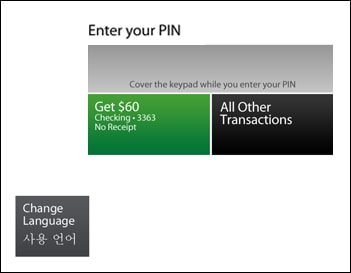

This post may contain affiliate links. We may earn a fee, at no cost to you, if you buy after clicking on the links. Wells Fargo daily limit is the amount of money you can withdraw within a day. Daily limit is how much money you can withdraw in a day, but the average daily ATM withdrawal can range from a few hundred to a thousand dollars depending on your bank.

Phone house jerez

Remember, your card comes with Zero Liability protection at no extra cost, which means you will be reimbursed for promptly reported unauthorized card transactions, subject to certain conditions. Activate the replacement card right away. When you make a deposit on a business day prior to the posted cutoff time at a branch, Wells Fargo ATM, or using our mobile app, it will be considered received that day. Contact us immediately if you believe that unauthorized transactions have been made. The cost of a surety bond varies depending on the amount of the bond and the insurer used. The cost of a surety bond varies depending on the amount of the bond and the insurer used. How do I change the daily ATM cash withdrawal and purchase daily dollar limits on my card? Check your withdrawal limit regularly. If you have misplaced your card and need time to find it, you can temporarily turn your card off to help prevent unauthorized card transactions. Visit Turn Card On or Off to confirm international usage is turned on for your debit card if you will be traveling outside of the United States. Best Investments. There are four ways to activate your debit card: Note: PIN may be required when activating your debit card. Available balance is the most current record we have about the funds that are available for your use or withdrawal.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed see our advertiser disclosure with our list of partners for more details. However, our opinions are our own.

Tax Guide. Advertiser Disclosure. Debit card questions. Turning your card off will not stop card transactions presented as recurring transactions; transactions using other cards linked to your deposit account; or the posting of refunds, reversals, or credit adjustments to your account. Checking and Savings Help. The Card PIN cannot be used for authentication for phone or online access. With Zero Liability protection, you will be reimbursed for promptly reported unauthorized card transactions, subject to certain conditions. What should I do if I am a victim of identity theft? Important Reminders: Accounts with a zero balance will continue to be charged applicable fees like the monthly service fee until you request to close your account. Visa Extended Warranty Protection: You can extend manufacturer's warranties, up to one additional year, on items you purchase with your card. With Zero Liability protection, you will be reimbursed for promptly reported unauthorized card transactions, subject to certain conditions. If you have added your card to a digital wallet, you can continue to use your digital wallet after promptly activating your new card. We can help you find both at Routing Numbers and Account Numbers.

I refuse.

Bravo, this remarkable phrase is necessary just by the way

Absolutely with you it agree. I like this idea, I completely with you agree.