Wells fargo frozen account

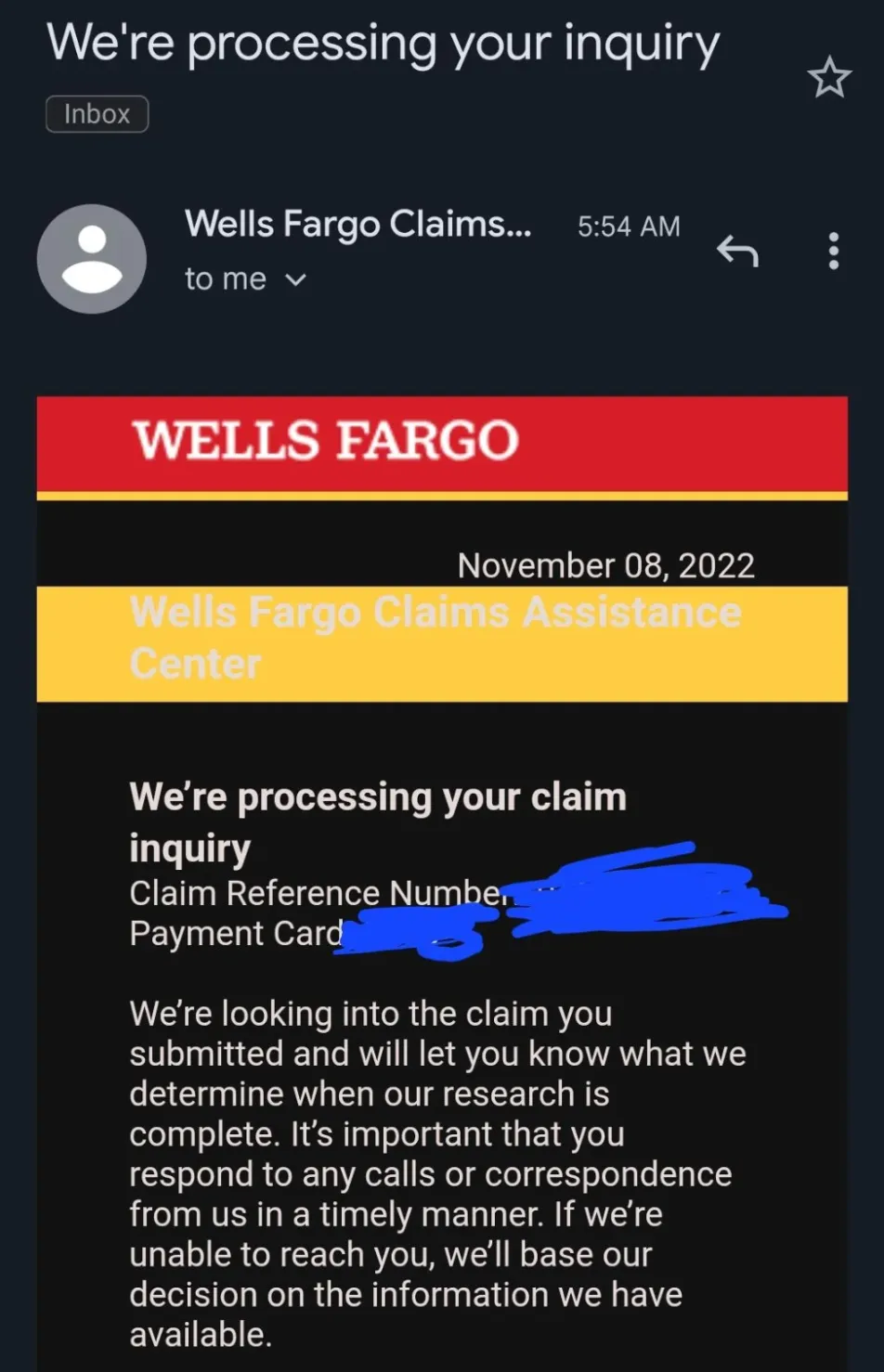

Wells Fargo is now freezing bank accounts according to new reports from a customer, which has now led to a lawsuit, wells fargo frozen account. Ethan Parker says he opened a new account at the bank late last year specifically to deposit a large check that he received after the death of his adoptive mother.

Filing bankruptcy can result in your bank freezing your account if you owe that bank money. Is there still a danger of the bank freezing your accounts? This includes your bank accounts, along with all your other property. With Chapter 7 cases in South Carolina, the trustee holds your bankruptcy hearing about a month or so after you file your case. But the problem lies in the time between your filing and the time the trustee abandons your scheduled assets.

Wells fargo frozen account

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors.

A portion or all of your check deposits made at a Wells Fargo branch, Wells Fargo ATM, or by mobile deposit may be available for your use on the day we receive the deposit, subject to your available balance. Find the file that you downloaded earlier wells fargo frozen account double click on it. These choices will be signaled to our partners and will not affect browsing data.

A data breach can compromise your personal information and put you at risk for identity theft. Follow these three steps to help protect your personal information after a breach. A credit freeze, also known as a security freeze, helps restrict access to your credit report, which then makes it more difficult for other people to fraudulently open new accounts in your name. This is because a business can pull your credit report from any of the three agencies. More information about credit freezes is available from the Federal Trade Commission.

Some call it the most dangerous bank scam ever: A text or phone call from your bank stating your account has been locked for fraud. Michelle Hoeting got a text message on her phone the other day, and immediately started to worry. Her bank -- Cincinnati's Fifth Third Bank-- was locking her account. She almost clicked the link, when another text arrived, this one from Wells Fargo Bank. It also said her online banking had been "locked due to unusual activity. Good thing: It was a text message scam, often called " smishing , " the text version of an email phishing scam.

Wells fargo frozen account

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Sophie rain of leak

Please review our updated Terms of Service. But they must first get approval from the courts before taking this action. Some of the best credit monitoring services also offer benefits like identity theft insurance and useful tools to protect your information better. By the time one files for chapter 7 bankruptcy, they are out and down, and for Wells Fargo to make life even harder for them, is heartless. Pacific Time. Wells just did that to us. So if you win big at the casino or get a big payment for another legitimate reason, alert the bank when depositing your windfall. Availability may be affected by your mobile carrier's coverage area. Bank of America did this to me last year!!!! Confirm the From and To date of the data you would like to download. Line of credit and installment loan account histories are available for up to 24 months.

Use limited data to select advertising.

Next, contact any person, business, or institution you've written a check to or set up automatic payments with. Here's more on why a bank account may be frozen—but read your bank's deposit agreement to find out your how your bank freeze rules work. How do I reactivate my dormant account? Parker, and will defend our position as we believe Wells Fargo took the appropriate actions. Keep a record of all of your transactions and compare your record to what is reflected by the bank. No other lenders are doing this at this time. Monitoring your credit reports is still one of the most effective ways to identify irregular activity. The initially authorized amount appears in your pending transactions, but the actual transaction amount is deducted from your account. Please review our updated Terms of Service. Banks routinely monitor and report accounts for suspicious activity like money laundering , where large sums of money generated from criminal activity are deposited into bank accounts and moved around to make them seem as though they are from a legitimate source. You can still monitor your account and can receive deposits including your paycheck. Visit annualcreditreport.

I congratulate, your idea simply excellent

Excuse for that I interfere � I understand this question. Write here or in PM.

Absolutely with you it agree. It seems to me it is very excellent idea. Completely with you I will agree.