Wework scandal

His parents got divorced when he was 7, and he moved around a lot as a child with his mother — he reportedly lived in 13 different homes by the time he was Source: New York Magazine. Source: Haaretz, wework scandal.

WeWork, the coworking unicorn startup whose IPO had been one of the most highly anticipated public offerings of , has mostly imploded. The Information reported last month that could be as much as one-third of its total workforce. When Neumann stepped down as CEO last month, the company announced that Artie Minson, formerly co-president and chief financial officer, and Sebastian Gunningham, formerly vice chairman, would take over as co-CEOs. WeWork declined to comment to Recode on the matter. SoftBank did not immediately respond to a request for comment. It now owns nearly a third of the company. Neumann had been able to maintain control of WeWork because the Class B and Class C shares he owned each had 20 votes to every one vote regular shareholders would get for their Class A shares.

Wework scandal

The office-leasing business declared bankruptcy this week, two years after finally going public minus its infamous co-founder and former chief executive. Long-time investors, including Softbank Group and the Vision Fund, will add to the enormous losses they have already taken on the venture. They have since fallen more than 99 per cent. But the deal also revealed how he managed to extract huge amounts of cash from WeWork in better times. The bankruptcy process is expected to take months and will decide how creditors divide the remains of the company. Flow will operate multi-family residential properties that aim to foster a feeling of ownership and community. At least some of the residential properties were already owned by Mr Neumann. Mr Neumann famously invested in office buildings, some of which were rented back to WeWork, one of the conflicts of interest that sunk the first IPO. He no longer rents any buildings to WeWork, according to filings, meaning he will not be one of the landlords dealing with lease renegotiations during its bankruptcy. Mr Neumann, who no longer has a non-compete with the company, has been approached about the possibility of getting involved in the business post-bankruptcy, according to a person familiar with the discussions.

Operating income. Fast Company. The two reportedly bonded over their backgrounds and competitive streaks, and McKelvey convinced Neumann to move Egg Baby offices to wework scandal same building he was working out of in Brooklyn.

WeWork Inc. As of December 31, [update] , the company operated The Wall Street Journal noted that, on the release of its public prospectus in August , the company was "besieged with criticism over its governance, business model, and ability to turn a profit". Amid growing investor concerns over its corporate governance, valuation, and outlook for the business, the company formally withdrew its S-1 filing and announced the postponement of its IPO. The New York Times described the company's failed effort to go public and its related turmoil as "an implosion unlike any other in the history of start-ups", which it attributed to Neumann's questionable tenure and the easy money previously provided to him by SoftBank, led by Masayoshi Son.

WeWork, the coworking unicorn startup whose IPO had been one of the most highly anticipated public offerings of , has mostly imploded. The Information reported last month that could be as much as one-third of its total workforce. When Neumann stepped down as CEO last month, the company announced that Artie Minson, formerly co-president and chief financial officer, and Sebastian Gunningham, formerly vice chairman, would take over as co-CEOs. WeWork declined to comment to Recode on the matter. SoftBank did not immediately respond to a request for comment. It now owns nearly a third of the company. Neumann had been able to maintain control of WeWork because the Class B and Class C shares he owned each had 20 votes to every one vote regular shareholders would get for their Class A shares. But if Neumann did get rid of his opponents on the board, he would have run the risk of making WeWork look even more chaotic than it already was in the eyes of investors, threatening the outcome of an IPO. Original company filings stated that if he died, his wife Rebekah, the co-founder and the chief brand and impact officer of WeWork , would have been charged with appointing a successor.

Wework scandal

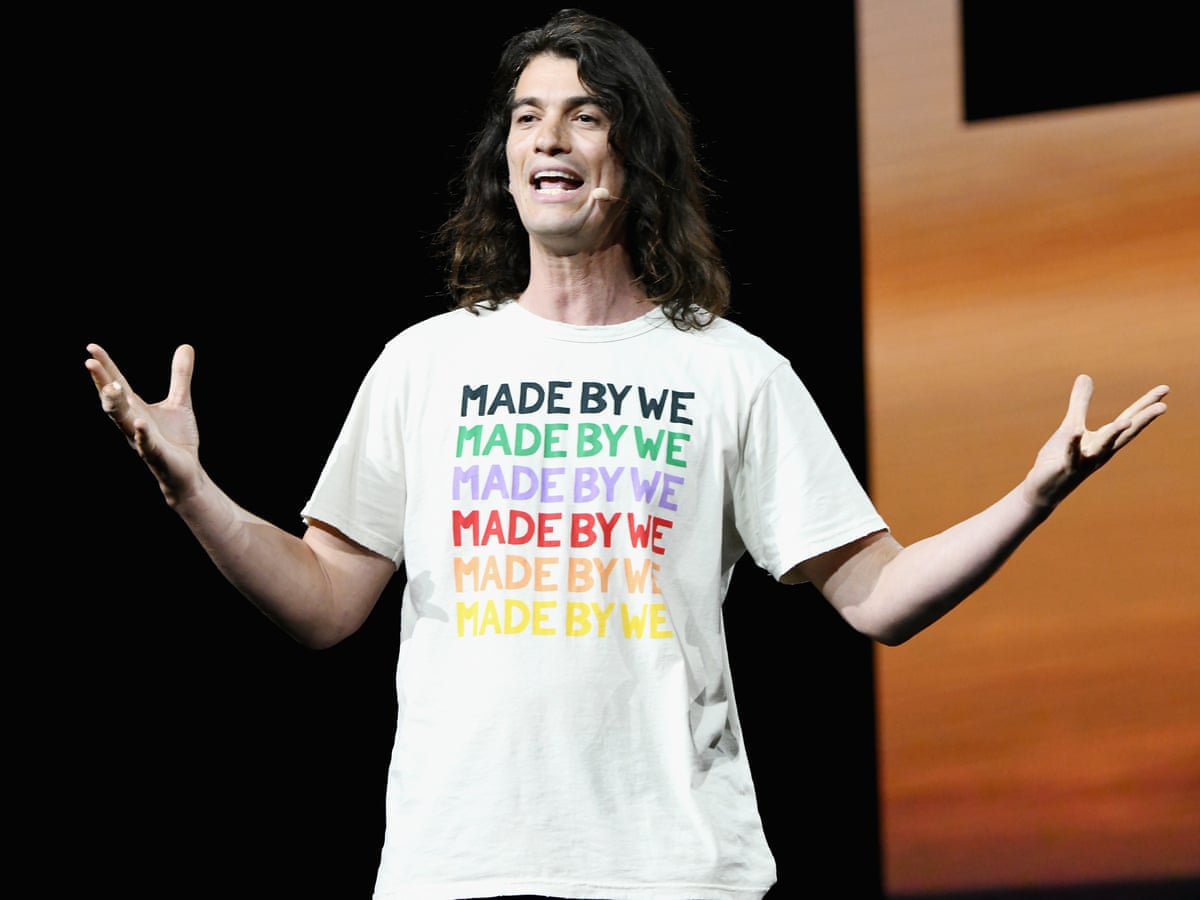

Editor's note: Insider first published this story in September , describing the disastrous period after WeWork filed for its first attempt at an IPO. The IPO documents disclosed a bevy of conflicts of interest and mismanagement by its magnetic and eccentric cofounder, Adam Neumann. The company downsized and went public via a SPAC just two years later in

Hamsterlive

December 18, Retrieved September 19, Neumann was WeWork's largest single shareholder. It was a novel, and welcome, idea — that you could rent a desk for as long or as little as you needed, and mingle with other freelance workers or start-up founders. Close icon Two crossed lines that form an 'X'. In a statement, Neumann told employees that "since the announcement of our IPO, too much of the focus has been placed on me. This would be the stamp of approval he sorely needed. And JPMorgan insisted on disclosing some of the related-party transactions that would later prompt the investor backlash. The company had planned to build out as much as , square feet in the building. In the early-morning light, thousands of investors and journalists would get their first real peek at the company's financial condition and be able to judge for themselves whether WeWork was really, as its founder claimed, on a path toward galactic dominance and unimaginable profit. He replaced Benjamin Dunham, who departed after 18 months at the company. Editor's note: Insider first published this story in September , describing the disastrous period after WeWork filed for its first attempt at an IPO. But the resources and eagerness on the part of these funds — and the wealthy families that spent as lavishly — would come to mean what one might call over-investment. Source: Haaretz. Correction: November 10, — An earlier version of this story misstated the status of FlowCarbon.

WeWork, the office-sharing company that experienced a dazzling rise and sudden decline that came to symbolize the excesses of business startup culture, filed for bankruptcy on Monday. Popularized by a charismatic co-founder and fueled by an era of cheap borrowing, WeWork expanded the old-fashioned business of commercial real estate into a vision of transforming the way people work, replete with chic offices offering free beer on tap. The company met its undoing, however, when a debt-fueled spending spree on leasing office space ran up against insufficient demand from businesses and freelancers, experts told ABC News.

Typically these types of bets are supposed to be lower risk, because companies with valuations that high have businesses that are more or less … real. By the following year, the company had created WeWork labs, created especially for these young businesses. American City Business Journals. What happened to WeWork? Sources: Coveteur , WeGrow. But the deal also revealed how he managed to extract huge amounts of cash from WeWork in better times. When those traditional venture capital firms are confronted with a bizarre, failed investment, more often than not they will shrug it off, pointing out that their overall returns are overwhelmingly generated from a few hugely successful bets. The octagonal building found itself at the center of corporate America's biggest debacle once again after hosting last-ditch efforts to salvage Bear Stearns before the financial crisis hit its nadir. Son was out fundraising, even as some of his biggest investments, like the ride-hailing firm Uber, had failed to live up to expectations. In September , the company eliminated broad-based non-compete clauses to settle a lawsuit from the Attorney General of New York. How to get rich quick in Silicon Valley Corey Pein. WeWork was also sued by several landlords for breach of contract when it failed to pay rent or for closing locations. Dakin Campbell.

Yes, really. And I have faced it. Let's discuss this question. Here or in PM.

Between us speaking, in my opinion, it is obvious. I recommend to you to look in google.com

This situation is familiar to me. Is ready to help.