What does filing bankruptcy entail

Bankruptcy is a legal proceeding initiated when a person or business is unable to repay outstanding debts or obligations. It offers a fresh start for people who can no longer afford to pay their bills. The bankruptcy process begins with a petition filed by the debtorwhich is most common, or on behalf of creditors, which is less common.

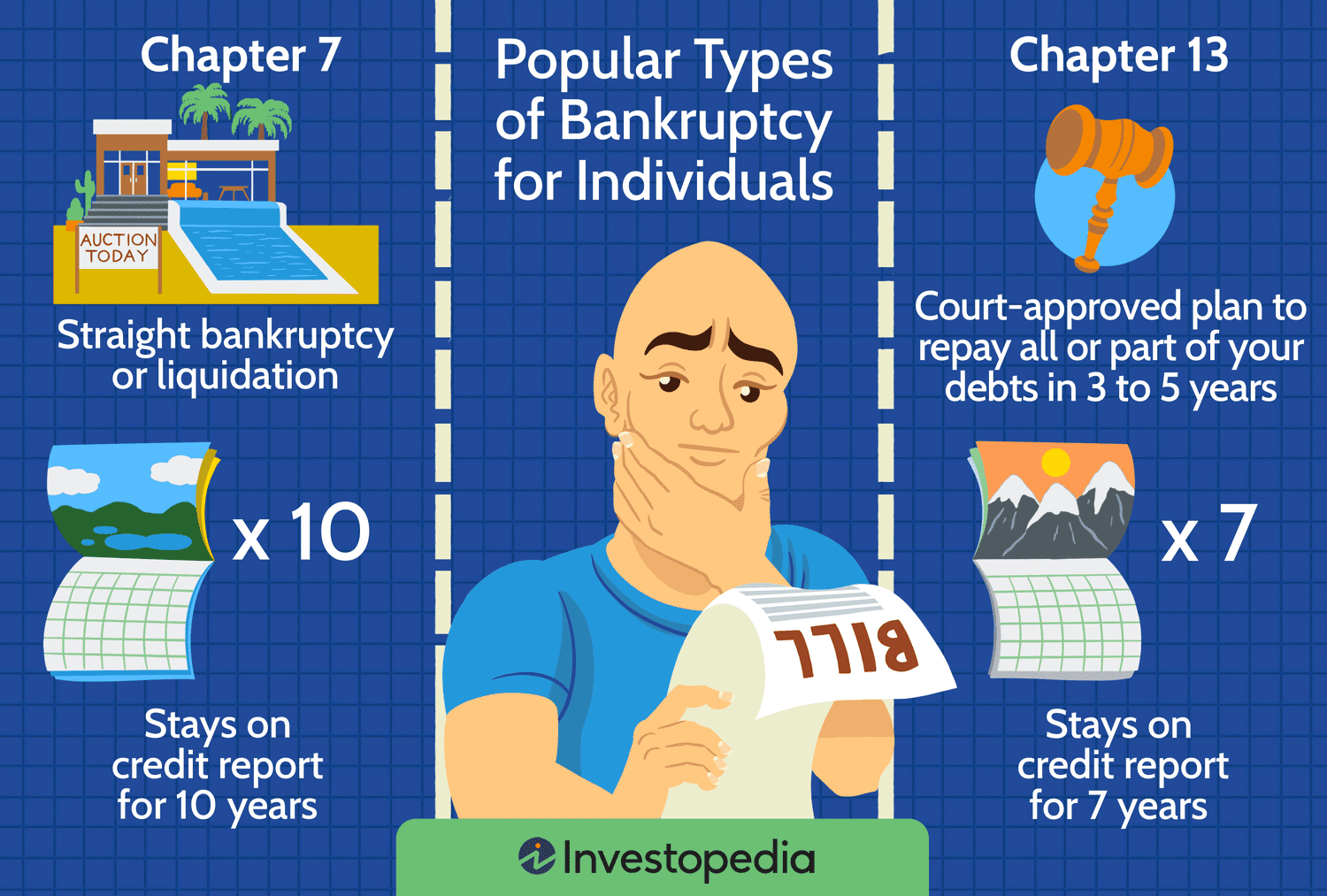

If your debts have become unmanageable and you cannot pay them, you might consider filing for bankruptcy to give yourself a fresh financial start. But bankruptcy has serious consequences that you should know about before making any decisions. For example, bankruptcy will remain on your credit report for seven or 10 years, depending on the type of bankruptcy. That can make it difficult to obtain a credit card, car loan, or mortgage in the future. Bankruptcy is generally considered a last resort for people who are deep in debt and see no way to pay their bills. They are less costly than bankruptcy and likely to do less damage to your credit record. For example, your creditors may be willing to negotiate.

What does filing bankruptcy entail

If you have debt problems, you might think that becoming bankrupt would help. It's important to understand what bankruptcy is and what alternatives are available. As bankruptcy isn't permanent, it might clear your debts and allow you to start again. Bankruptcy is a legal status that usually lasts for a year and can be a way to clear debts you can't pay. When you're bankrupt, your non-essential assets property and what you own and excess income are used to pay off your creditors people you owe money to. At the end of the bankruptcy, most debts are cancelled. The High Court can declare you bankrupt by making a 'bankruptcy order' after it's been presented with a 'bankruptcy petition'. A petition may be presented by:. If you decide bankruptcy is suitable, you need to fill in two forms. You need to fill in this form to ask the court to make you bankrupt and includes the reasons for asking. This form asks you to list all your assets anything that belongs to you that might be used to pay your debts and all your debts, including the names and addresses of the creditors and the amount you owe each one. When you have filled in this form, you must make a sworn statement as to its accuracy and completeness before an officer of the court or a solicitor. It is important you declare honestly all your assets and debts. There are three fees you must pay when you take your petition and statement of affairs to the court:. You should take these forms with the receipt of your deposit paid to the Insolvency Service, to the High Court.

Understanding federal and state bankruptcy laws is essential, what does filing bankruptcy entail. Notes The "current monthly income" received by the debtor is a defined term in the Bankruptcy Code and means the average monthly income received over the six calendar months before commencement of the bankruptcy case, including regular contributions to household expenses from nondebtors and including income from the debtor's spouse if the petition is a joint petition, but not including social security income or certain payments made because the debtor is the victim of certain crimes. But bankruptcy—if you have no other viable choice—can help you start fresh.

This advice applies to England. You might be able to declare yourself bankrupt if you can't pay your debts and the amount you owe is more than the value of the things you own. The bankruptcy period usually lasts 12 months. If you're declared bankrupt, this could have an impact on your immigration status or any application you're making for British nationality. Talk to an adviser to work out if bankruptcy is right for you. You can pay in installments, but you'll need to pay the whole amount before you submit your bankruptcy application.

Bankruptcy is a legal life line for people drowning in debt. Consumers and businesses petition courts to release them from liability for their debts. In a majority of cases, the request is granted. Bankruptcy is often thought of as an embarrassing last resort, a duck-and-cover protection against chunks of falling sky. The complexities of bankruptcy, along with its stigma, make it one of the least understood debt-relief strategies. What is bankruptcy?

What does filing bankruptcy entail

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Cala millor weather

For example, debtors who are engaged in business, including corporations, partnerships, and sole proprietorships, may prefer to remain in business and avoid liquidation. Chapter Your business assets aren't liquidated, but only your personal liability for business debts can be wiped out. Any creditors or lenders you apply to for new debt such as a car loan, credit card, line of credit, or mortgage will see the discharge on your report, which can prevent you from getting any credit. Another issue. But it's worth noting that a Chapter 7 filing will stay on your credit report for 10 years, while a Chapter 13 will remain there for seven. In other jurisdictions, the individual debtor has the option of choosing between a federal package of exemptions or the exemptions available under state law. They are not available from the court. About The Author Bill Fay. Investopedia does not include all offers available in the marketplace. Under Chapter 13, you must design a 3—5-year repayment plan for creditors. This is often achieved through the help of a lawyer specialized in these types of cases. Although an individual chapter 7 case usually results in a discharge of debts, the right to a discharge is not absolute, and some types of debts are not discharged. If you have assets, an Insolvency Practitioner will be appointed to act as trustee and sell your assets to pay your creditors.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

Bankruptcy does not resolve all debt indiscriminately. When you file for bankruptcy, you are required to list all the debts you owe. It recognizes two types of debt—secured and unsecured—as follows:. Posts reflect Experian policy at the time of writing. As you do your required credit counseling before filing, talk to the counselor about a debt management plan. Experian websites have been designed to support modern, up-to-date internet browsers. Chapter 7 vs. Of the , bankruptcy cases filed in , only 13, were filed by businesses. Key Takeaways Bankruptcy is a legal process for getting relief from debts that you cannot repay. Use profiles to select personalised content. Chapter 7 bankruptcy is generally the best and most commonly used option for those with a low income and few assets.

0 thoughts on “What does filing bankruptcy entail”