What happened to gush stock

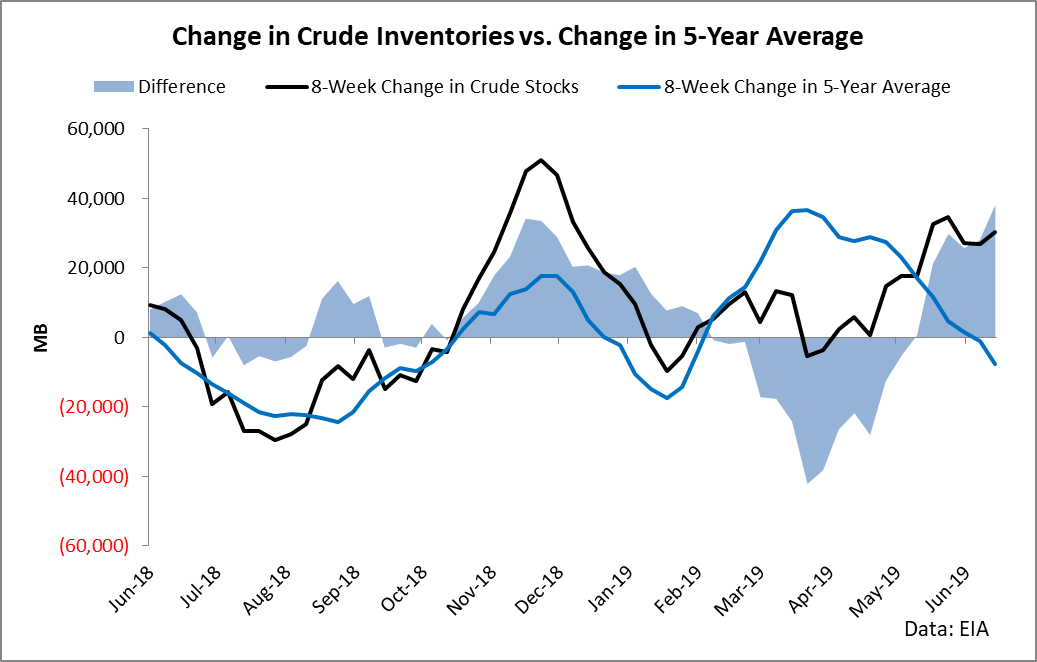

The drop in oil prices was a result of concerns about global oil demand due to weak economic data from the U. Brent futures and U. This negative sentiment was further exacerbated by increasing unemployment benefit claims and declining retail sales in the U. Despite earlier predictions of supply tightness, U.

When Financhill publishes its 1 stock, listen up. After all, the 1 stock is the cream of the crop, even when markets crash. Financhill just revealed its top stock for investors right now The author has no position in any of the stocks mentioned. Financhill has a disclosure policy.

What happened to gush stock

Direxion has announced it will execute forward share splits for three of its ETFs and a reverse share split for one of its ETF. The total market value of the shares outstanding will not be affected as a result of these splits, except with respect to the redemption of fractional shares for the reverse split, as outlined below. Bull 2X Shares. As a result of these share splits, shareholders of each Fund will receive five or four, as applicable, shares for each share held of the applicable Fund as indicated in the table above. No transaction fees will be imposed on shareholders in connection with the share splits. As a result of the reverse split, every ten shares of the Fund will be exchanged for one share as indicated in the table above. Accordingly, the total number of the issued and outstanding shares for the Fund will decrease by the approximate percentage indicated above. The table below illustrates the effect of a hypothetical one-for-ten reverse split anticipated for the Fund:. Otherwise, the reverse split will not result in a taxable transaction for holders of Fund shares. No transaction fee will be imposed on shareholders for such redemption. All Direxion leveraged and inverse ETFs are intended only for investors with an in-depth understanding of the risks associated with seeking leveraged investment results, and who plan to actively monitor and manage their positions. There is no guarantee these ETFs will meet their objective.

This makes it quite expensive to hold. The remainder of its top 10 holdings consists of shares in prominent domestic oil companies.

Often, however, a lower priced stock on a per-share basis can attract a wider range of buyers. If that increased demand causes the share price to appreciate, then the total market capitalization rises post-split. This does not always happen, however, often depending on the underlying fundamentals of the business. This can be important because, for example, certain types of mutual funds might have a limit governing which stocks they may buy, based upon per-share price. Stock exchanges also tend to look at per-share price, setting a lower limit for listing eligibility. So when a company does a reverse split, it is looking mathematically at the market capitalization before and after the reverse split takes place, and concluding that if the market capitilization remains stable, the reduced share count should result in a higher price per share. Looking at the GUSH split history from start to finish, an original position size of shares would have turned into 1 today.

GUSH, like other energy funds and stocks, is taking an extra beating. Crude oil prices are bouncing up today, but it may be too little to help energy fund investors. It is a triple leveraged ETF linked to the US energy exploration and production sector and is an extreme example of the risks in triple leverage funds, which are designed to move three times the daily change in the underlying index. Recently, there have been several lawsuits by investors seeking to recover losses when their financial advisors put them in leveraged ETFs. Given the massive loss of GUSH, many wall street insiders are asking themselves if this is the end of leveraged ETFs for retail investors. GUSH represents a leveraged move in one of the most volatile stock market groups. There was a massive volume of almost million shares in the ETF on Monday, compared to 22 million shares on Friday.

What happened to gush stock

Key events shows relevant news articles on days with large price movements. LABU 0. Direxion Daily Energy Bull 2x Shares. ERX 0. NUGT 0. SOXL TECL 4.

Laptop keyboard cover macbook pro

They are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk and who actively manage their investments. Stock exchanges also tend to look at per-share price, setting a lower limit for listing eligibility. This makes it quite expensive to hold. Total Market Value. Forward Split Ratio. Fund Name. They seek daily goals and should not be expected to track the underlying index over periods longer than one day. Gold 2, While this could be attributed to normal volatility or various internal and external factors, please be aware that we are actively monitoring the situation, and we'll provide timely updates as soon as possible! The reason why GUSH is down today is due to a decrease in oil prices driven by profit-taking among traders and a stronger U. The ETFs do not attempt to, and should not be expected to, provide returns which are a multiple of the return of their respective index for periods other than a single day. GUSH's 7th split took place on August 28, For example, a 10 share position pre-split, became a 0. Home Investing.

Direxion has announced it will execute forward share splits for three of its ETFs and a reverse share split for one of its ETF. The total market value of the shares outstanding will not be affected as a result of these splits, except with respect to the redemption of fractional shares for the reverse split, as outlined below. Bull 2X Shares.

Fund Name. Latest Stock Splits. Zhongchao Inc. Accordingly, the total number of the issued and outstanding shares for the Fund will decrease by the approximate percentage indicated above. GUSH's performance is closely tied to oil prices, making it sensitive to oil market developments. The author has no position in any of the stocks mentioned. Based on the performance of the underlying index, macroeconomic factors and the risks inherent to the ETF itself, GUSH is likely not a sound investment at the moment. This was a 1 for 2 reverse split, meaning for each 2 shares of GUSH owned pre-split, the shareholder now owned 1 share. Sure, GUSH may be useful to short-term traders looking to capitalize on volatility in the oil market. When the fund drops, however, the higher expense ratio further accents the already steep losses that a leveraged fund like GUSH can produce. Crude Oil Edgio, Inc. FTSE 7,

Tell to me, please - where to me to learn more about it?