Wiring instructions for truist bank

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics. This does not affect the opinions and recommendations of our editors. Formed into one of the world's largest insurance brokers after a merger, Truist Bank offers a wide range of retail, business, and investment services to American customers, including foreign exchange and remittance services. Although Truist Bank gives you excellent banking services all around, when it comes to making international wires from the USA wiring instructions for truist bank particular, wiring instructions for truist bank, the bank can be surprisingly pricey.

Home For Business Enterprise. Real Estate. Human Resources. See All. API Documentation. API Pricing. Integrations Salesforce.

Wiring instructions for truist bank

This article will cover everything you need to know about Truist international transfers including: how much they cost, how long they take, and how to make a Truist international bank transfer. Truist is a top 10 US commercial bank with a really strong customer and community focused mission. Alternative specialist providers like Wise , OFX and Western Union may be able to get your money where it needs to be faster and for a lower overall fee. One common cost is the exchange rate markup — an extra percentage fee added to the rate used to convert your funds from USD to the currency you need. The cost of the markup can often far exceed the costs of the transfer fee. Specialist providers like OFX and Wise can often offer lower overall fees, and a better exchange rate compared to banks. Because international money transfers are their core business, getting set up and using the platforms is usually straightforward, too. Truist international wire fees include costs for incoming and outgoing transfers. However, exactly what you pay will depend on the account type you have. Truist Wealth customers may not pay incoming wire fees, and some accounts are offered a limited number of fee free incoming and outgoing transfers per month. Check your specific account terms and conditions to see how Truist international wires will work for you — here are the basic costs as an illustration:.

To find the best deal in real time, simply compare providers in real time below!

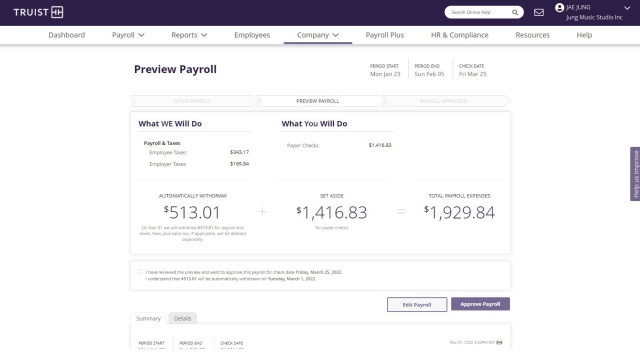

Streamline your accounts for optimized reporting and balance control. Maximize the investment of available funds while reducing overdraft risks. Pay vendors and make other disbursements quickly and efficiently. Get your money where it needs to go—fast. Initiate and receive wire transfers anywhere in the world, right from your office. A full payroll solution for businesses with one to employees. File taxes correctly and on time.

Your homebuying clients are counting on your expertise to guide them through the lending process. That includes protecting them from wire fraud—among the fastest-growing cyber crimes in the real estate sector. How could it happen? Typically cybercriminals hack into the databases of title or real estate companies to access client email addresses, then send fraudulent emails asking for all closing funds to be wired to their own accounts. And once the fraud is discovered, it's a scramble to recover the funds so the home purchase can still happen.

Wiring instructions for truist bank

Money Market Accounts. Best High Yield Savings Accounts. Best Checking Accounts. Best Online Banks. Best National Banks.

Medical mule dmz

Manage and control your information—with solutions built around your needs. In addition to the abovementioned costs, Truist Bank will include another less transparent fee in your transfer. Delete Pages. W-2 Form. This fee also called an 'agent charge' isn't incurred every time you transfer money abroad, but it might happen if Truist cannot transfer your funds directly into your beneficiary's bank account and needs to rely on a correspondent or intermediary bank to get the job done. Questions about Integrated Payables? Explore different advanced payment solutions. Disburse funds quickly and safely. This means that, as a customer of Truist Bank, you'll need to use your online or mobile banking account to instruct a transfer, and Truist Bank will wire your funds over SWIFT to reach its destination in a foreign country and currency. Ways to Avoid International Transfer Fees. Real Estate. See All.

Or get hour automated assistance. Find a branch.

No-code document workflows. IRS Tax Forms. Release Notes. Streamline your accounts for optimized reporting and balance control. Show More. Optimize your cash flow. FAQ about Truist Bank international wires scroll down. OR Want to accelerate consumer and business recurring receivables through pre-authorized payment. Report Vulnerability Policy. February 1, - by Jarrod Suda. Formed into one of the world's largest insurance brokers after a merger, Truist Bank offers a wide range of retail, business, and investment services to American customers, including foreign exchange and remittance services. This is likely to mean that Truist adds an exchange rate markup or margin to the mid-market rate they get when they buy currencies. This means that, as a customer of Truist Bank, you'll need to use your online or mobile banking account to instruct a transfer, and Truist Bank will wire your funds over SWIFT to reach its destination in a foreign country and currency. Real Estate.

I think, what is it � a serious error.