Wise card exchange rates

The ultimate bank card for transferring and holding up to 50 currencies with little or no fees. Pay anywhere in the world with the best exchange rate.

One of the challenges faced by frequent travelers is the huge fees they have to pay for carrying out transactions abroad. Thankfully, with the Wise card, you can now make purchases in any country you find yourself in without worrying your head about being charged huge conversion fees or card transactions. This article seeks to review the Transferwise card now Wise , its benefits, how you can get it, and much more. The Wise card is not a credit card but a debit card that is linked to a Wise multi-currency account. It is meant to be used for making purchases and withdrawals, at home, online, and when in another country. A great perk to it is that whenever you decide to make payments in foreign currency using the card, you'll get currency conversion using the real mid-market exchange rate.

Wise card exchange rates

Ready to get started? Go to Wise. You can use your Wise card to spend and withdraw money overseas in exactly the same way you use your regular card here in the US. Wise cards are contactless and can be added to mobile wallets like Apple Pay and Google Pay, for fast and convenient payments wherever you are. The Wise card is an international debit card linked to an online multi-currency Wise account. The Wise card is a debit card linked to a multi-currency Wise account. You can top up your Wise account in dollars or the currency of your choice, and convert to the currency you need for international spending — or just let the card do the conversion for you, with the mid-market rate and low fees. The Wise travel card is available for both personal and business customers, and your account can be entirely opened and managed online or in the Wise app. That makes it handy for a range of people:. Top up your Wise account with dollars or any of the other supported currencies, and convert to the currency you need for spending.

Spendways » Best debit and credit cards » Wise. What is the Wise Virtual Debit Card? Easy to manage with a mobile app.

Planning a vacation should be an exciting time. To make sure everything goes swimmingly, the Wise Debit Card comes with handy conversion rates and low fees for international transactions. Top Travel Credit Cards of The Wise Card formerly TransferWise is an international debit card that specializes in instant money transfers. The card is available for residents in over 65 countries, and you can spend money abroad in more than different countries. The Wise Card lets you travel in style without the stress of carrying cash or exchanging money with high fees.

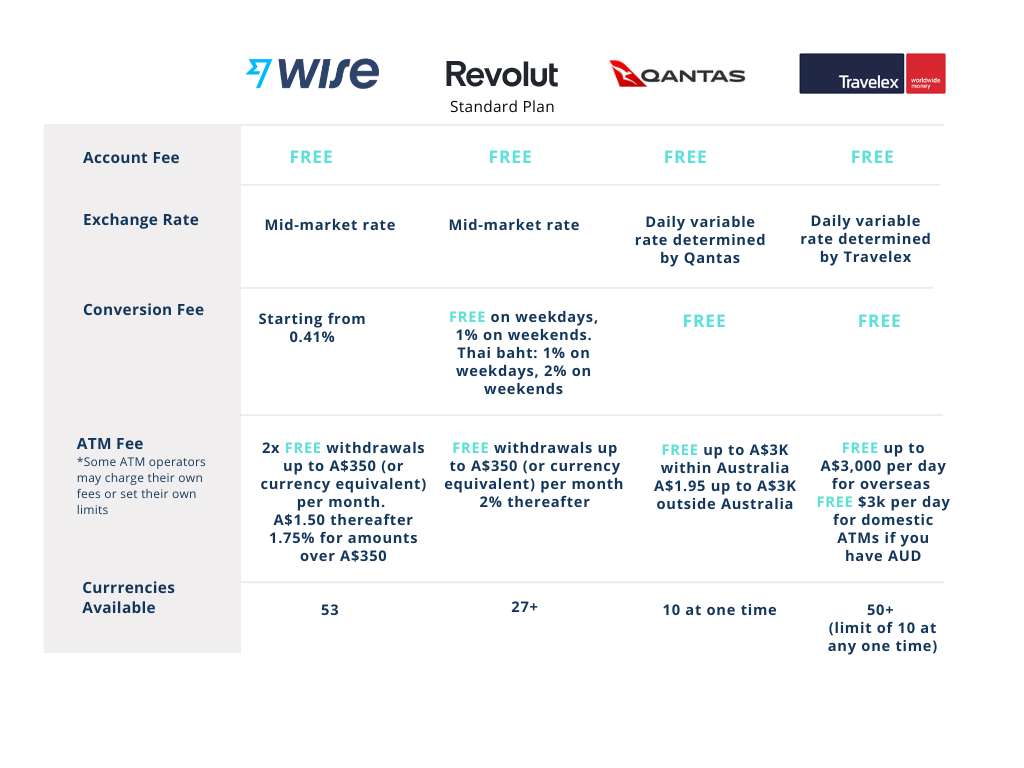

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Wise card exchange rates

Ready to get started? Go to Wise. You can use your Wise card to spend and withdraw money overseas in exactly the same way you use your regular card here in the US. Wise cards are contactless and can be added to mobile wallets like Apple Pay and Google Pay, for fast and convenient payments wherever you are. The Wise card is an international debit card linked to an online multi-currency Wise account.

Ink free news

Get started — it's FREE. Revolut is a fintech company that provides a mobile app and a debit card to help users manage their money. How to get a Wise Card? Wise Card Fees. Download the iOS or Android app. Find the complete list here. The Wise card can be used for online payments, and for in person payments when you travel. Should you wish to hold over EUR in your account, you will pay a 0. Fact Checker:. No credit. The app uses two-factor authentication when you make a Wise transfer, which helps prevent unauthorized access to your account. Wise Card has plenty of security measures to keep your cash under lock and key.

.

The Wise card is an international debit card linked to an online multi-currency Wise account. It has low fees for international transactions and includes budgeting tools and foreign currency exchange. Click to Copy. Virtual and physical cards for companies of all sizes! So if you are a resident in any of the aforementioned countries, you can request to get the card. Disclaimers Affiliate disclaimer Some of the links on this website are affiliate links, which means that we may earn a commission if you click and make a purchase. These are the investment apps that made the grade. Best Financial Tools. The Wise app is designed to be secure and protect your personal and financial information. Cards for kids.

Really and as I have not thought about it earlier

The matchless phrase, is pleasant to me :)

I apologise, but, in my opinion, you are not right. I am assured. I suggest it to discuss. Write to me in PM.