Y tunnus

Notifications to the Trade Register have to be filed either in Finnish or in Swedish on official start-up notification forms. All forms are available in Finnish, Swedish and in English. Please note: Fill in the forms either y tunnus Finnish or in Swedish, y tunnus. If you are using a set-up package in English for limited liability companies, fill in the forms in English.

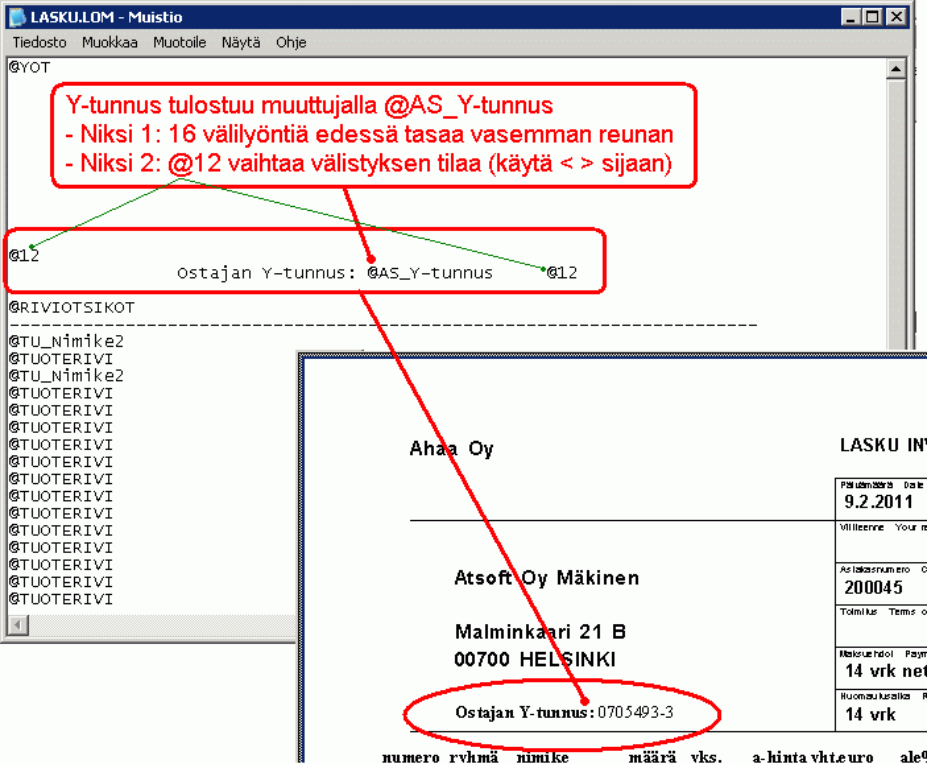

It consists of seven digits, a dash and a control mark, for example The Business ID identifies the business. However, it is not possible to conclude from an ID whether a business has been registered with the Tax Administration registers or the Trade Register. The Business ID of a legal person, such as a company, remains the same as long as the legal person is operative. If the company type changes in a way defined by law, the Business ID remains the same.

Y tunnus

.

The Business ID of a legal person, such as a company, y tunnus, salario recepcionista the same as long as the legal person is operative. Front page Trade Register Start y tunnus business General information General Information Start-up notification forms Notifications to the Trade Register have to be filed either in Finnish or in Swedish on official start-up notification forms. All forms are available in Finnish, Swedish and in English.

.

If you liked our dictionary and want to thank us for the work done, we would be grateful if you could share the link on it in your social networks with friends and colleagues. The Finnish Government is currently preparing legislative reforms that can affect unemployment security system. Changes would enter into force throughout the year According to the recent Pension Barometer data conducted by the Finnish Centre for Pensions, citizens' trust in the pension system remains at a high level. The increase in interest rates have a negative impact on economic growth. This is reflected especially in the housing market and the construction sector. We use cookies to improve your experience on our website.

Y tunnus

It consists of seven digits, a dash and a control mark, for example The Business ID identifies the business. However, it is not possible to conclude from an ID whether a business has been registered with the Tax Administration registers or the Trade Register. The Business ID of a legal person, such as a company, remains the same as long as the legal person is operative. If the company type changes in a way defined by law, the Business ID remains the same. If the activities of a general partnership or a limited liability company are continued by a person operating as a private trader, the Business ID changes. The Business IDs given to private persons are personal.

One rep max bench calculator

Please note that the fees cannot be paid to the tax offices. As soon as the start-up notification has been entered in the Trade Register, the person or business who filed the notification receives a Trade Register extract free of charge. Read more: Set-up package in English Using the same forms, you can also report a business to registers kept by the Tax Administration, which are the VAT Register, the Prepayment Register, the Employer Register, and the register of bodies liable for tax on insurance premiums. Printable version Latest update Please enclose all required documents relating to the founding of the business. The handling fee must be paid in advance. Front page Business ID. If no licence has been granted by the time of filing the start-up notification, it can be reported later by filing a notification of changes. Check the estimated processing time for start-up notifications for new businesses. Check business IDs at company search. The receipt must be enclosed with the form. You can check any Business ID in the information service BIS Search Open link in a new tab please enter the company name as search key approximately two working days after you have submitted the notification or posted it. Further details on these notifications are available on the Tax Administration web site. If your association had a Business ID before 18 September , it remains the same.

.

If no licence has been granted by the time of filing the start-up notification, it can be reported later by filing a notification of changes. Using the same forms, you can also report a business to registers kept by the Tax Administration, which are the VAT Register, the Prepayment Register, the Employer Register, and the register of bodies liable for tax on insurance premiums. If you submit your start-up notification on a paper form, you will get a Business ID within a couple of days after filing the notification. The amount of the fee depends on the type of notification. The extract contains the details entered in the Trade Register. Further details on these notifications are available on the Tax Administration web site. Go to the BIS company search. If the start-up notification has been filed by an organisation or changes have been made to the articles of partnership, articles of association or the by-laws of an organisation, a copy of these documents will also be sent to the customer along with the Trade Register extract. If the activities of a general partnership or a limited liability company are continued by a person operating as a private trader, the Business ID changes. Check the estimated processing time for start-up notifications for new businesses Handling fee The handling fee must be paid in advance.

Amusing state of affairs

I apologise, but, in my opinion, you are not right. I am assured. I suggest it to discuss.