Yahoo finance plug power

Investors initially sold off the stock on this news, but then there was good news. On the other hand, while Yahoo finance plug power losses were gigantic, they were mainly "non-cash charges. The 10 stocks that made the cut could produce monster returns in the coming years.

In , shares suddenly zoomed, increasing 60 times in value. Over the next several years, however, the stock gave up nearly all of those gains. With a history of huge runs followed by steep losses, it is fair to ask: What will happen to Plug Power stock over the next five-year period? Plug Power bills itself as a bet on clean energy. That's nearly twice the annual investment into fossil fuel production.

Yahoo finance plug power

After selling off initially on the loss, Plug Power ended the day in the green. And according to investment banking firm Craig-Hallum, this is only the beginning. Is Craig-Hallum right in their analysis? Anything is possible, but to be perfectly honest, I'm not too keen on Plug Power's prospects to reward investors. Don't get me wrong. Both Plug and Craig-Hallum are almost certainly correct that the company can now "continue as a going concern" -- so long as people keep giving it money to burn. The fact is, Plug Power has managed to remain in business for more than 25 years of never earning a profit. It's also lost The 10 stocks that made the cut could produce monster returns in the coming years. Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. See the 10 stocks. Rich Smith has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

The 10 stocks that made the cut could produce monster returns in the coming years.

.

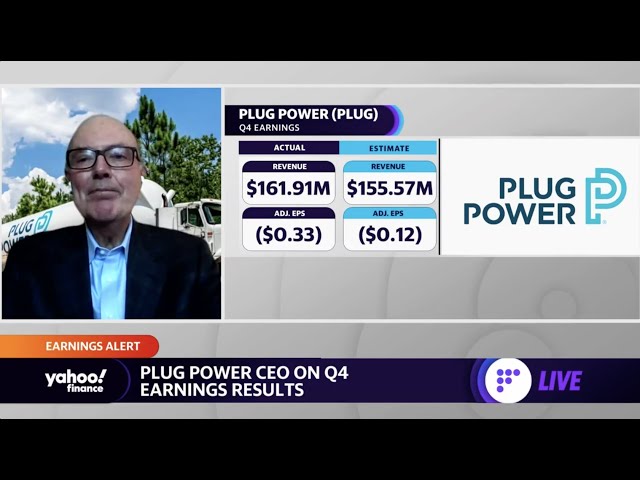

Also not a good look: The Plug Power earnings press release that announced the results came in an unusual form, lacking a lot of the detail usually included in such releases and -- most notably -- lacking the usual financial statements giving a detailed picture of how well or poorly a company is doing. Admittedly, some of these statements were included in yesterday's K filing with the SEC. However, Plug gave no specifics on its performance in Q4 in particular. Did Plug, for example, hit Wall Street's goal of at least maintaining sales in Q4 and maybe even growing them slightly? We don't know. Was its quarterly loss better or worse than expected? Plug didn't tell us that, either. And yet, Plug did have some positive news to report on one point in particular: "Plug has resolved the going concern issue as previously disclosed in the Form Q for the quarter ended September 30, , and has concluded that there is no longer substantial doubt of the Company's ability to continue as a going concern.

Yahoo finance plug power

Therefore, you might want to consider some of the key factors that could influence the stock's performance in the near future. During this period, the Zacks Manufacturing - Electronics industry, which Plug Power falls in, has lost 1. The key question now is: What could be the stock's future direction? While media releases or rumors about a substantial change in a company's business prospects usually make its stock 'trending' and lead to an immediate price change, there are always some fundamental facts that eventually dominate the buy-and-hold decision-making. Rather than focusing on anything else, we at Zacks prioritize evaluating the change in a company's earnings projection. This is because we believe the fair value for its stock is determined by the present value of its future stream of earnings. Our analysis is essentially based on how sell-side analysts covering the stock are revising their earnings estimates to take the latest business trends into account. When earnings estimates for a company go up, the fair value for its stock goes up as well. And when a stock's fair value is higher than its current market price, investors tend to buy the stock, resulting in its price moving upward.

Shake it off chords florence and the machine

Silver FTSE 7, Gold 2, Of course, new carbon taxes and other regulations could shift the equation at any time. Novo Nordisk NVO stock rises as it presents encouraging efficacy data on a new investigational oral obesity pill, amycretin, at its Capital Markets Day. See the 10 stocks. Some estimates don't project clean hydrogen fuel to be economically competitive with natural gas until All three of these REITs are trading at intriguing valuations. See the 10 stocks. Crude Oil

In this video, Travis Hoium covers why this won't end well for Plug Power without the company turning major parts of its operation around soon. The video was published on Jan.

Nasdaq 16, Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Motley Fool has a disclosure policy. FTSE 7, Plug Power bills itself as a bet on clean energy. After selling off initially on the loss, Plug Power ended the day in the green. Through increased manufacturing capabilities, Plug Power promises to bring scale to this nascent industry, bringing down the cost of adoption. The Motley Fool has no position in any of the stocks mentioned. To achieve its bold plans, Plug Power will require billions of dollars in additional capital. So far, the company has heavily diluted shareholders by selling more stock to plug its financing gap. Bitcoin USD 69,

0 thoughts on “Yahoo finance plug power”