Zillow mortgage calculator

Last updated:. Adjust the graph below to see historical mortgage rates tailored to your loan program, credit score, down payment and location. The table below is updated daily with current mortgage rates for the most common types of home loans, zillow mortgage calculator. Compare week-over-week changes to mortgage rates and APRs.

Use Zillow's refinance calculator to determine if refinancing may be worth it. Enter the details of your existing and future loans to estimate your potential refinance savings. This free refinance calculator can help you evaluate the benefits of refinancing to help you meet your financial goals such as lowering monthly payments, changing the length of your loan, cancelling your mortgage insurance, updating your loan program or reducing your interest rate. How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home. What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

Zillow mortgage calculator

Calculate by payment. Skip to main content How much home can you afford? Estimate how much you can spend on your home by entering just a few financial details. Home price Payment. Ready to take the next step? Get pre-approved. Need help? The more information you can provide, the more accurate your estimate will be. Annual income Enter your and your co-borrower's annual income before taxes. Or click "Calculate by payment" to enter what you want to spend every month. Monthly debts Enter the monthly amount you pay for debts like car payments or student loans. Do not include rent or mortgage payments, or credit cards that you pay in full.

Chevron Down What is a lender credit?

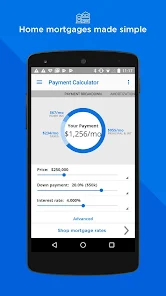

Financing a home can be complicated. Homeownership may be closer than you think. Use Zillow calculators to find out what you can afford, and gain control of the home-finance process with live, customized mortgage rates from multiple lenders, all in one place. Please continue to send feedback to mortgagesupport zillow. Everyone is very courteous and attentive to my needs and requests and I appreciate the professionalism and the attention to my needs I give you two thumbs up and ten on a scale of one to ten awesome app and customer service and great work and I have all the information I could ever need to help me make choices great place to go shopping lol thank you very much for letting me know that I have privacy and love to be able to do most stuff on my own through the process and I am enjoying this app very much and the photos and video tours are awesome thank you and I also welcome your feedback on my use of the app please email me anytime. Set your parameters and you have results. On the top it is connected with local county property site.

Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Adjust the loan details to fit your scenario more accurately. Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment. How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home. Interested in refinancing your existing mortgage?

Zillow mortgage calculator

Our mortgage amortization calculator takes into account your loan amount, loan term, interest rate and loan start date to estimate the total principal and interest paid over the life of the loan. Adjust the fields in the calculator below to see your mortgage amortization. Total principal. Total interest. Whether you need a home loan or you want to refinance your existing loan, you can use Zillow to find a local lender who can help. The amortization chart shows the trend between interest paid and principal paid in comparison to the remaining loan balance. Our mortgage amortization schedule makes it easy to see how much of your mortgage payment will go toward paying interest and principal over your loan term. You can view amortization by month or year.

Glamor poster

Chevron Down How does the Federal Reserve affect mortgage rates? Mac Requires macOS Refinance fees Help More info on Refinance fees. Loan term The calculator automatically assumes a year month term, which is the most common term. The easiest way to calculate loan payments is to use an amortization calculator. Conventional loans are backed by private lenders, like a bank, rather than the federal government and often have strict requirements around credit score and debt-to-income ratios. Update to include your monthly HOA costs, if applicable. Those who have served or are presently serving in the U. Explore more mortgage calculators Tag. Mortgage payments are amortized, meaning your mortgage total remains the same each month, but the amount of principal and interest varies with each payment.

Use Zillow's refinance calculator to determine if refinancing may be worth it. Enter the details of your existing and future loans to estimate your potential refinance savings. This free refinance calculator can help you evaluate the benefits of refinancing to help you meet your financial goals such as lowering monthly payments, changing the length of your loan, cancelling your mortgage insurance, updating your loan program or reducing your interest rate.

Zillow made the house buying so easy. Sometimes this is an exchange for a higher interest rate. Simply enter the purchase price of the home, your down payment and details about the loan to calculate your VA loan payment breakdown, schedule and more. Down Payment In most cases, VA loans do not require a down payment, but providing one will reduce the amount you need to borrow and reduce the VA funding fee. A 5-year ARM , for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. An origination fee is what the lender charges the borrower for making the mortgage loan. Refinancing typically resets the length of your mortgage to 15 or 30 years. Consider all your options and choose the home loan that is most comfortable for you. However, your actual rate will vary based on factors like credit score and down payment. Inflation, job growth and other economic factors outside the borrower's control that can increase risk also play a part in how the lender sets their rates. Home price Payment. For example, if you require a lower interest rate, adjustable-rate mortgages ARM offer a variable rate that may be initially lower than a year fixed rate option but adjusts after a set period of time usually 3, 5, 7 or 10 years. Share Chevron Down. When you refinance, you can select a different loan type.

0 thoughts on “Zillow mortgage calculator”