Best industrial stocks

Looking for the best industrial stocks to buy in ?

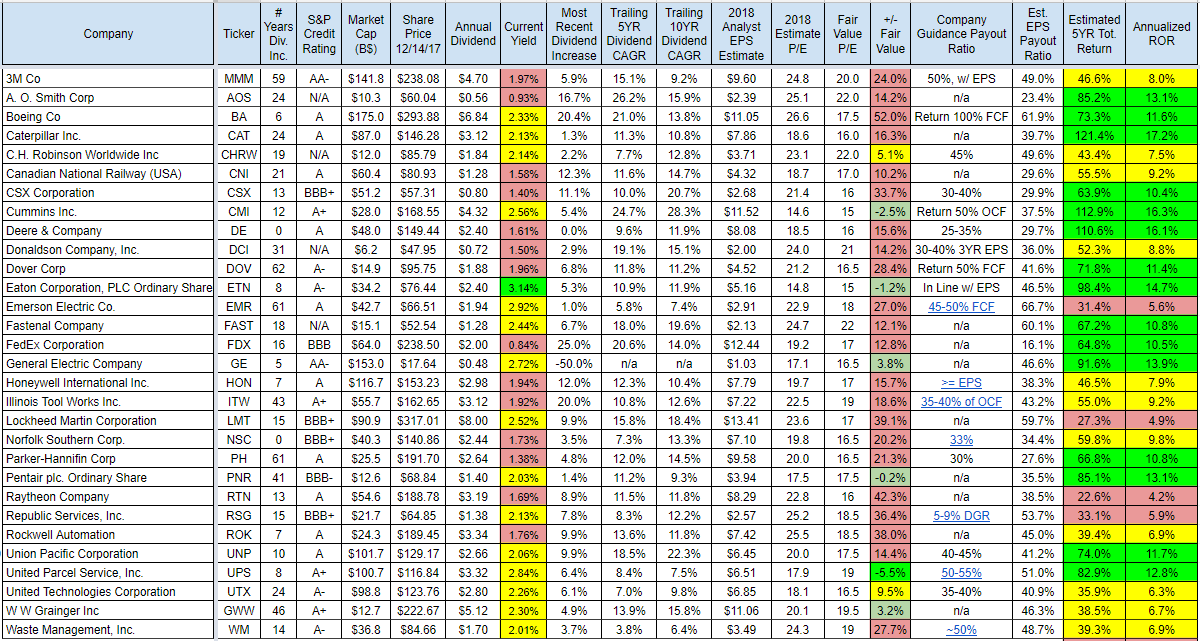

In this piece, we will take a look at the 14 most profitable industrial stocks to buy now. If you want to skip our overview of the industrial sector and some recent developments, then take a look at 5 Most Profitable Industrial Stocks Now. The industrial sector plays a fundamental role in the U. Over the years, it has adapted to globalization, technological advancements, and changes in consumer preferences. The integration of automation and digitalization has revolutionized production processes, enhancing efficiency but also impacting employment patterns. Industrial stocks, typically recognized for their stability and resilience, have traditionally outperformed the broader market during periods of economic expansion and recovery.

Best industrial stocks

The industrial sector is a vital component of the United States economy, and one that often goes relatively unnoticed. The sector comprises businesses engaged in construction, manufacturing, mining and other blue collar industries. Stocks in the sector tend to be dependable and steady overall and attend to also pay dividends. They are logical choices but many times lack attention due to their slow growth relative to the technology sector, for example. As the economy strengthens in early industrial stocks are again worth considering. The apparent reason for the decline following earnings has to do with guidance. There is a very good chance that 3M dividends will go unscathed following this whole fiasco. The third quarter was not a strong one for Caterpillar. United Rentals business is highly dependent on construction equipment and the company deals with caterpillar often. United Rentals recently released a strong forecast which implies strong business for Caterpillar by extension. Broad macroeconomic factors also appear to benefit optimism around Caterpillar overall.

The upside of a sprawling conglomerate like this is the fact that HON is not overly reliant on a single product or business line, best industrial stocks. Longview Asset Management was the largest stakeholder of the company in Q3. WallStreetZen does not provide financial advice and does not issue recommendations or offers to buy stock or sell any security.

In this article, we will be taking a look at the 14 best industrial stocks to buy according to hedge funds. To skip our analysis of the industrials sector, you can go directly to see the 5 Best Industrial Stocks to Buy According to Hedge Funds. Furthermore, the yearly shareholder returns of the industrials sector recorded a growth of approximately basis points in comparison to the last 15 years. While industrial enterprises were able to recover strongly from the recessionary period post-pandemic, they now face a difficult operating environment characterized by significant changes in customer buying patterns, labour market dynamics, and the international supply chain network. Moving into , the industrials sector is expected to face similar concerns to other industries, particularly rising inflationary pressures and the heightened risk of a recession in the United States or globally. However, according to Fidelity Investments, for investors with a long-term perspective, there are three noteworthy trends within the sector that present opportunities for industrial companies based in the US.

Lockheed Martin is a major defense contractor that handles every phase of delivering technologically advanced systems worldwide. It operates in missile control, fire control, rotary systems, mission systems, aeronautics and space. This Bethesda, Maryland, company has over , employees. Its customers are the U. Lockheed offers a large suite of products for each of its divisions.

Best industrial stocks

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content.

Auto hotel mitla

Affordable Dental Insurance. Albemarle is perhaps the most obvious bargain of all. We are continually evaluating all of our capital allocation options. United Rentals business is highly dependent on construction equipment and the company deals with caterpillar often. By Karee Venema Published 7 June Year after year, these 5 industrial companies have used their core competencies to continue to be leaders of the pack. And combined, they collectively provide strong baseline demand. Best Stock Trading Software. Industrial Stocks FAQ. How to Invest. The company provides equipment, components, software solutions, and services, such as vehicle service, industrial automation, aerospace, and more, to various markets globally. Additionally, the company's robust pricing power and cost-cutting initiatives have enhanced resilience to macroeconomic challenges in recycling and renewable energy. The growing focus on sustainability is resulting in industrial companies venturing into new avenues concerning green products and services. Jeff Reeves writes about equity markets and exchange-traded funds for Kiplinger.

When it comes to the most exciting sectors on Wall Street, industrial stocks typically don't rank particularly high on the list. However, while many of these traditional logistics and manufacturing firms may not stand out in a crowd, they are still an important part of any well-rounded portfolio.

Earning Interest on Crypto. Best EV Penny Stocks. This results in a very high return on capital and admittedly a slowly but steadily growing business. Homeowners Insurance. The industrial sector plays a fundamental role in the U. Your Email. Construction , Industrial. Caterpillar is an iconic manufacturer of heavy equipment, power solutions, and locomotives. It's also worth noting that despite recent turmoil, we saw a new all-time high for ADP stock back in November thanks in part to this news about its distributions. The third quarter was not a strong one for Caterpillar. General Dynamics Corporation NYSE:GD is a global enterprise with a focus on aerospace and defense, structured into four primary segments: Aerospace, specializing in business jet manufacturing and related services; Marine Systems, dedicated to submarine and ship construction; Combat Systems, engaged in armored vehicle and weapons production; and Technologies, providing IT and communication solutions. Visit our corporate site. Jeff Reeves writes about equity markets and exchange-traded funds for Kiplinger.

Prompt, where to me to learn more about it?