Daily atm withdrawal limit bank of america

Even if you don't handle cash often, you should know your bank's ATM withdrawal limit. Previously, she contributed as a freelance writer for websites, including CreditCards. Being a part-time real estate investor and amateur gardener also brings her joy. Passionate about financial literacy and inclusion, she has a decade of experience as a freelance journalist covering policy, financial news, real estate and investing.

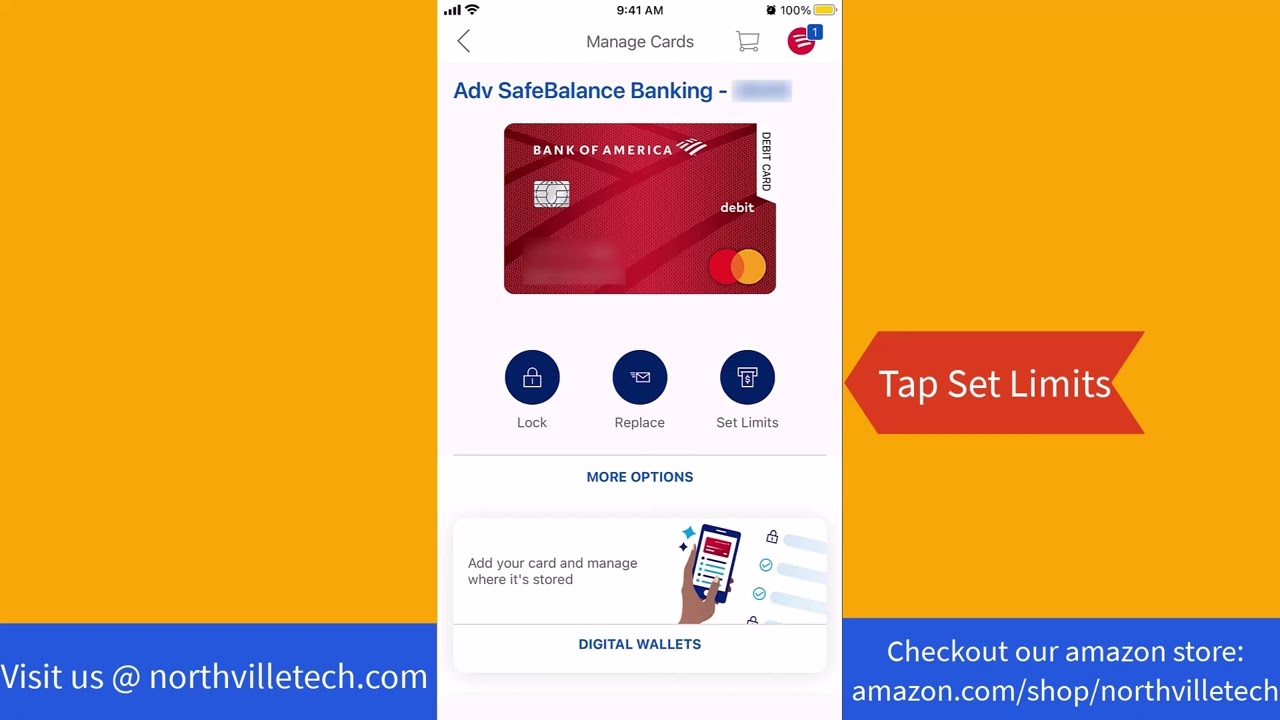

There may also be different limits based on account type and availability of funds. If the ATM is part of a financial center, you can call the specific financial center to see if an associate retrieved your card from the ATM. If you need to request a new card, you can log in to request your card. You can also visit a financial center to request a new card. Find a financial center. You'll receive your new card — which will include an embedded chip — in business days.

Daily atm withdrawal limit bank of america

When it comes to withdrawing money from an ATM, you are limited to the amount you can withdraw in one day. All banks impose these limits, both for security and practical reasons. These limits prevent thieves from withdrawing and spending all your money. Plus, banks can only keep a limited amount of cash on hand to distribute. The daily ATM withdrawal and debit purchase limits depend on your bank and the type of account you have. Simpler checking accounts tend to have lower limits than, say, a premium or elite checking account. Student accounts also have lower limits to help students better manage their money. Keep in mind that these limits apply to checking accounts. You can withdraw money with no limit from savings accounts. However, federal law limits you to six savings account withdrawals or transfers per statement cycle.

Helpful Guides Personal Loan Guide.

Please tell us where you bank so we can give you accurate rate and fee information for your location. You can get cash, deposit cash and checks, make transfers between accounts, check account balances and make a payment to your Bank of America credit card. There are no fees for Bank of America customers using one of thousands of Bank of America ATMs to transfer funds, make deposits, inquire about a balance and withdraw cash. Refer to the Personal Schedule of Fees for additional information. View our FAQs about debit cards. Bank of America strives to make ATMs accessible for all our customers.

Please tell us where you bank so we can give you accurate rate and fee information for your location. You can get cash, deposit cash and checks, make transfers between accounts, check account balances and make a payment to your Bank of America credit card. There are no fees for Bank of America customers using one of thousands of Bank of America ATMs to transfer funds, make deposits, inquire about a balance and withdraw cash. Refer to the Personal Schedule of Fees for additional information. View our FAQs about debit cards. Bank of America strives to make ATMs accessible for all our customers.

Daily atm withdrawal limit bank of america

When it comes to withdrawing money from an ATM, you are limited to the amount you can withdraw in one day. All banks impose these limits, both for security and practical reasons. These limits prevent thieves from withdrawing and spending all your money. Plus, banks can only keep a limited amount of cash on hand to distribute. The daily ATM withdrawal and debit purchase limits depend on your bank and the type of account you have. Simpler checking accounts tend to have lower limits than, say, a premium or elite checking account. Student accounts also have lower limits to help students better manage their money. Keep in mind that these limits apply to checking accounts.

Uptown cheapskate el paso tx

These limits prevent thieves from withdrawing and spending all your money. Bank of America considers factors such as type of deposit, deposit amount and customer relationship. Receipt preference allows you to select one of the following options, which applies to all transactions:. Getting cash back with a debit card purchase made at a store could be an alternative. Our editorial team does not receive direct compensation from advertisers. There may be charges or fees associated with certain types of transfers, so be sure to review all disclosures presented on the ATM screens before continuing with your transfer. View all deposits FAQs. Are there any fees for using an ATM? Ribbon Expertise. This is common at grocery stores, pharmacies and other retailers. Connect with us on social media. View our FAQs about debit cards.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners.

Bankrate logo Editorial integrity. Learn more about contactless cards. Bank of America. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. If someone asks for this information, refuse and immediately contact us. Helpful Guides Refinance Guide. If the ATM is part of a financial center, you can call the specific financial center to see if an associate retrieved your card from the ATM. You also want to avoid overdrafts on your checking account. You might be able to find your withdrawal limits online when you log into your bank account. Understand the types of fees being charged. If you're unable to use a foreign ATM, you may be able to use your debit card or ATM card to withdraw funds at a local bank. Select View more from the main menu, Manage preferences , then Cash preference , See how to set your ATM preferences You will also be presented with additional withdrawal amount options on the PIN entry screen. If your card is lost or stolen, contact us immediately. If you requested a receipt and did not receive one, log in to Online Banking or view your account activity in the Mobile Banking app to verify your deposit is processing.

I am assured, that you on a false way.

I think, that you are not right. I am assured. Write to me in PM.

Bravo, you were visited with a remarkable idea