Enbridge dividend increase

Enbridge Inc. This makes the dividend yield 7.

Enbridge Inc. ENB expects increased core earnings for The company has elevated its dividend outlook for , banking on a rise in demand to boost the volumes transported through its network. The positive outlook is based on the anticipated increase in demand, supported by the ongoing trend of growing profits in the Canada oil and gas transportation sector. This is the primary unit of the company, supported by robust system utilization. Enbridge is strategically positioned to sustain consistent growth well into the future.

Enbridge dividend increase

.

This is the primary unit of the company, supported by robust system utilization. The company could be more focused on returning cash to shareholders, but this could indicate that growth opportunities are few and far between.

.

The next Enbridge Inc dividend is expected to go ex in 2 months and to be paid in 3 months. The previous Enbridge Inc dividend was There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 1. Enter the number of Enbridge Inc shares you hold and we'll calculate your dividend payments:. Sign up for Enbridge Inc and we'll email you the dividend information when they declare.

Enbridge dividend increase

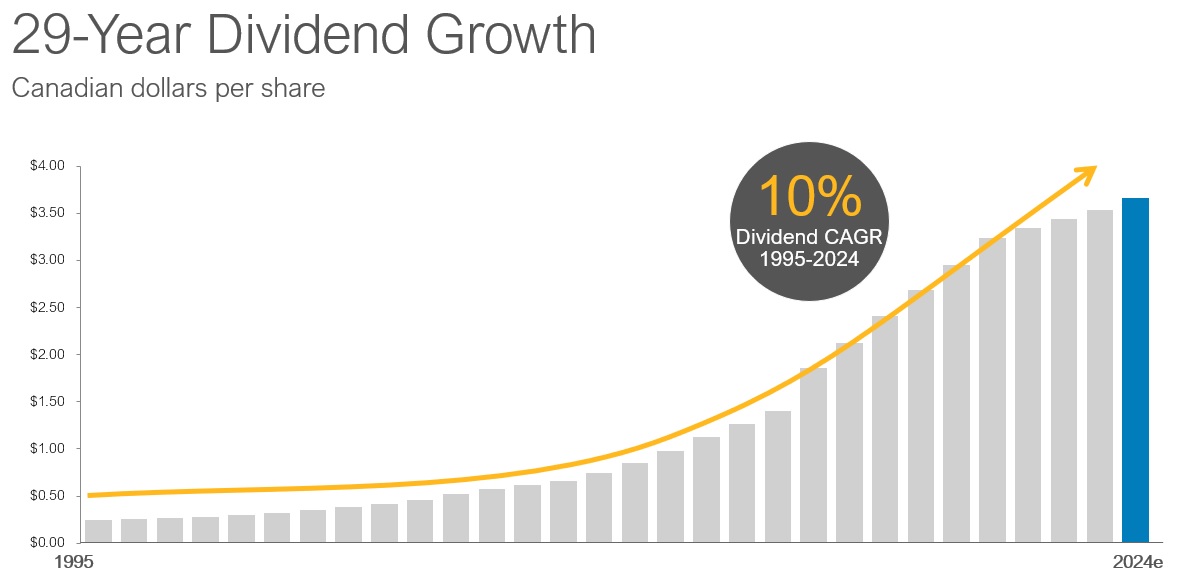

All financial figures are unaudited and in Canadian dollars unless otherwise noted. Declared 29 th consecutive annual common share dividend increase, raising it by 3. All figures, including EBITDA, DCF, capital expenditures, share counts, debt issuances and financial derivative figures, unless specified otherwise, in this news release are presented excluding the impact of the Acquisitions 1. We understand the critical role we play in powering communities and economies, and we are dedicated to expanding our infrastructure to ensure energy accessibility for all. Enbridge will continue to innovate and invest in the infrastructure required to strengthen our position as the first-choice energy delivery provider in North America and beyond. Given that we expect to realize only partial year contributions from the Acquisitions, we are issuing our guidance on the base business and excluding the impact of any contributions related to them. As indicated previously, we anticipate closing all three gas utility acquisitions by the end of This could include our ongoing capital recycling program, senior and subordinated debt issuances, reinstatement of our DRIP program, and at-the-market equity issuances.

Synonym of anymore

Bitcoin USD 51, While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Enbridge will pay out a quarterly dividend of It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Russell 2, Nasdaq 16, Gold 2, The company has a long history of increasing the value of its shareholders, courtesy of steady cash flows. Read full article. The company has an extended history of paying stable dividends. ENB expects increased core earnings for

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. ENB stock.

Dow 30 39, In alignment with this optimistic financial outlook, the company has announced a 3. Nasdaq 16, The company has an extended history of paying stable dividends. Nikkei 39, View our latest analysis for Enbridge. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. This makes the dividend yield 7. Crude Oil Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Enbridge Inc.

You commit an error. Write to me in PM, we will talk.

I apologise, but, in my opinion, you are mistaken. I can prove it. Write to me in PM, we will talk.