Great southern bank flexi saver

Fact checked. It has overcustomers and offers a wide range of personal banking products, including transaction and savings accounts. Savvy compares savings accounts from many different financial institutions to bring you up-to-the-minute account comparison information.

In this guide. If you're an existing CUA customer you should have been notified directly about these changes. We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision. Learn how we maintain accuracy on our site. The everyday account comes with a Visa debit card to make purchases in stores or online, and has no monthly account keeping fee. This account does charge international transaction fees, so it's best for use within Australia to avoid these fees.

Great southern bank flexi saver

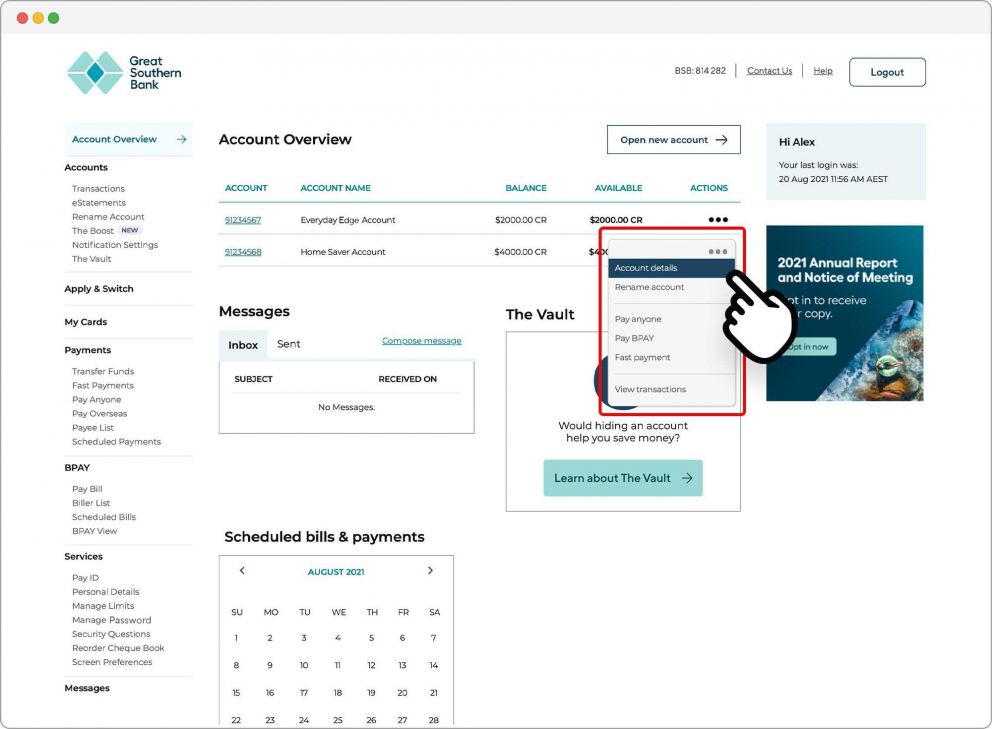

Great Southern Bank offers a range of savings accounts to cater for different customers, such as:. Monthly Deposit Min. These products may appear prominently and first within the search tables regardless of their attributes and may include products marked as promoted, featured or sponsored. Rates correct as of March 2, View disclaimer. Ensure you are eligible to apply: As mentioned above, there are several eligibility requirements to check before you apply for a Great Southern Bank savings account. Apply online : Applications should take around five minutes, you'll also need a valid form of ID. Ensure Everyday Edge is your main transaction account: If customers don't already have an Everyday Edge Account, one will need to be opened to qualify for bonus interest on savings. Watch the savings grow : Customers should assign their savings into the Great Southern Bank Goal Saver Account and earn bonus interest. This account allows customers to save for their home deposit faster by earning a competitive bonus interest rate. Great Southern Bank has developed some handy 'smart tools', giving customers access to clever ways to save. This tool ensures customers avoid the temptation to dip into their savings by hiding the account in The Vault. The Boost allows customers to save every time they spend.

Pros Customer-owned.

This product is not currently available via Finder. Visit the provider's website directly, or compare other options. This rate of 4. This account could suit you if you want to earn a decent amount of interest without having to jump through any hoops. There are also no monthly deposit conditions to meet, so it could suit you if you don't have a regular income or simply don't want to have to remember to make a monthly deposit. This account offers an ongoing variable rate of 4. You don't need to meet any account conditions to earn this rate.

If account is closed prior to posting date, all interest for that time period is forfeited. Interest rates are subject to change at any time without notice. Ask an associate for details. There is a daily overdraft limit of five 5 charges per day. Overdrafts should be repaid as soon as possible and must be repaid within 30 days. Whether overdrafts will be paid is discretionary and we reserve the right not to pay. Entry-level and perfect for starting a savings plan. With Statement Savings you get our basic savings plan.

Great southern bank flexi saver

The Great Southern Bank eSaver Flexi savings account is simple and flexible, with an interest rate of 4. On top of this, this account charges no ongoing account fees and gives you unlimited free transactions over the phone and online, making it a great set and forget option for savers. Plus it's a winner!

East county rednecks gb 2

Cash Mgmt Accounts. Credit Union Australia. Finder makes money from featured partners , but editorial opinions are our own. What is the nearest office to post cod Reply. Better than the big banks for sure. Fact checked At Savvy, we are committed to providing accurate information. Rabobank High Interest Savings Account. Finder makes money from featured partners , but editorial opinions are our own. How likely would you be to recommend finder to a friend or colleague? Savvy's content writing team are professionals with a wide and diverse range of industry experience and topic knowledge. Great Southern Bank eSaver Flexi. I cant find any reference to a PP account on your website.

This product is not currently available via Finder. Visit the provider's website directly, or compare other options. This rate of 4.

Great Southern Bank is an alternative to the big banks, offering financial, health and insurance solutions to over , Aussies. Mozo users have rated Great Southern Bank savings accounts on price, features, convenience, trust and customer service so you can see what real Aussies have to say about their experiences. Go to site View details Compare. What is your feedback about? Documentation needed Personal identification. They have no monthly fees and lock up your money for the length of the term you choose in return for a higher interest rate than achievable through a standard savings account. What's hot 4. Offshore Accounts. You will need a valid driver's licence, passport, birth certificate or Medicare card to complete the online application. Carol anne, Queensland reviewed about 2 years ago. Shirley April 28, Finder. We encourage you to use the tools and information we provide to compare your options.

Bravo, brilliant idea and is duly