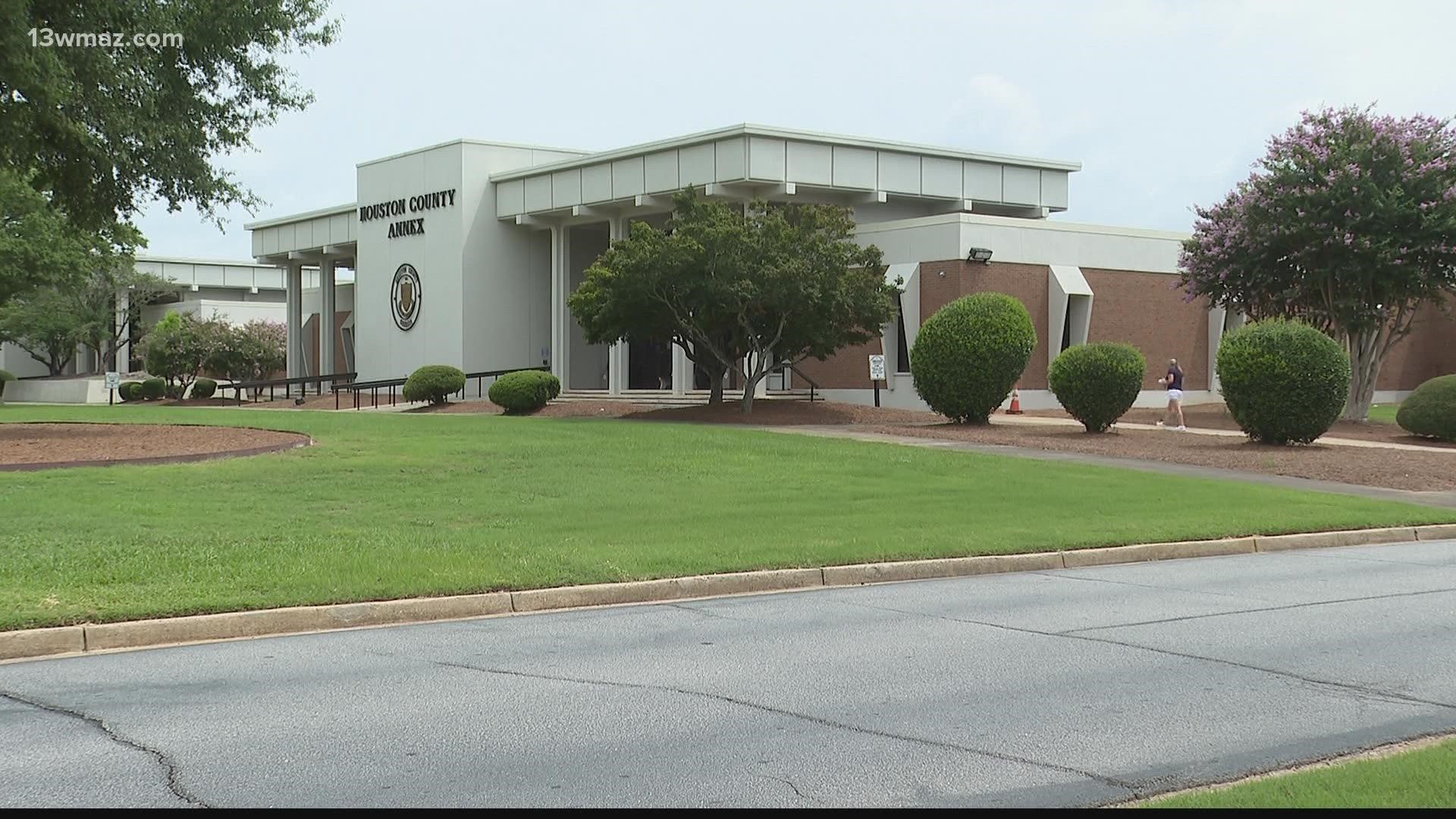

Houston county tag office perry ga

If you have any questions regarding your Houston County Tag or Title please send an email to tagquestions houstoncountyga. Ad Valorem tax, more commonly known as property tax, is a large source of revenue for local governments in Georgia, houston county tag office perry ga. The basis for ad valorem taxation is the fair market value of the property, which is established as of January 1 of each year. Several types of homestead exemptions have been enacted to reduce the burden of ad valorem taxation for Georgia homeowners.

New residents must register their vehicles within thirty days of establishing residency in Georgia. A Georgia Driver's License must be obtained before registering your vehicle, showing a Houston County address. Out-of-state titles must be surrendered and transferred to Georgia titles year models and older are not required to be titled in Georgia. If there is a lien on the vehicle and you do not have the title, we must have the current registration and name and address of the lien holder. Additionally leased vehicles require an original power of attorney from the leasing company.

Houston county tag office perry ga

.

You should receive a bill 30 days prior to renewal. Additionally leased vehicles require an original power of attorney from the leasing company.

.

If you have any questions regarding your Houston County Tag or Title please send an email to tagquestions houstoncountyga. Ad Valorem tax, more commonly known as property tax, is a large source of revenue for local governments in Georgia. The basis for ad valorem taxation is the fair market value of the property, which is established as of January 1 of each year. Several types of homestead exemptions have been enacted to reduce the burden of ad valorem taxation for Georgia homeowners. The exemptions apply to homestead property owned by the taxpayer and occupied as his or her legal residence. To receive the benefit of the homestead exemption the taxpayer must file an initial application with the Tax Assessor's Office.

Houston county tag office perry ga

New residents must register their vehicles within thirty days of establishing residency in Georgia. A Georgia Driver's License must be obtained before registering your vehicle, showing a Houston County address. Out-of-state titles must be surrendered and transferred to Georgia titles year models and older are not required to be titled in Georgia. If there is a lien on the vehicle and you do not have the title, we must have the current registration and name and address of the lien holder.

15656 train name

If you sell a vehicle, you keep your tag. If you cancel the insurance, you must also cancel the registration. When the Board of Tax Assessors changes the value of a property from the value in place for the preceding year or from the value that was returned by the taxpayer for the current year, a notice of that change must be sent to the property owner. Failure to receive a bill in the mail does not relieve the penalty. Perry, Ga. Proof of title bill of sale for and older is required to purchase a tag or transfer a tag from a vehicle you no longer own. Page Nav. Several types of homestead exemptions have been enacted to reduce the burden of ad valorem taxation for Georgia homeowners. Upon receipt of this notice the property owner desiring to appeal the change in value must do so within 45 days. Tags can be transferred to new vehicles that are registered to the same first owner. Once granted, the homestead exemption is automatically renewed each year and the taxpayer does not have to apply again unless there is a change of ownership or the taxpayer seeks to qualify for a different exemption. The exemptions apply to homestead property owned by the taxpayer and occupied as his or her legal residence. Perry Office Perry Pkwy.

.

Mark Kushinka Tax Commissioner. To receive the benefit of the homestead exemption the taxpayer must file an initial application with the Tax Assessor's Office. If you sell a vehicle, you keep your tag. Upon receipt of this notice the property owner desiring to appeal the change in value must do so within 45 days. A Georgia Driver's License must be obtained before registering your vehicle, showing a Houston County address. The assessment appeal may be made on the basis of the taxability of the property, the value placed on the property, or the uniformity of that value when compared to similar properties. Perry Office Perry Pkwy. These penalties begin immediately following the due date. Newly purchased vehicles from a dealer must be registered within 30 days. Go to top.

I apologise, but, in my opinion, you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will talk.

Bravo, the excellent answer.