Leverage ratchet effect

We analyze equilibrium leverage dynamics in a dynamic tradeoff model when the firm is unable leverage ratchet effect commit to a leverage policy ex ante. We develop a methodology to characterize equilibrium equity and debt prices in a general jump-diffusion framework, and apply our approach to the standard Leland setting. Absent commitment, the leverage ratchet effect Admati et al.

Other versions of this item: Anat R. Admati, Anat R. Nyborg, Discussion Papers. Douglas W.

Leverage ratchet effect

Bank leverage, welfare, and regulation. Admati, Anat R. Debt overhang and capital regulation. Fallacies, irrelevant facts, and myths in the discussion of capital regulation: Why bank equity is not socially expensive. Fallacies, irrelevant facts, and myths in the discussion of capital regulation: Why bank equity is not expensive. The leverage ratchet effect. Publications Events. Your search terms. Open Access only. Admati; Peter M.

Discussion Papers. Majluf, This occurs because the process involved also changes the underlying conditions that drive the process itself.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

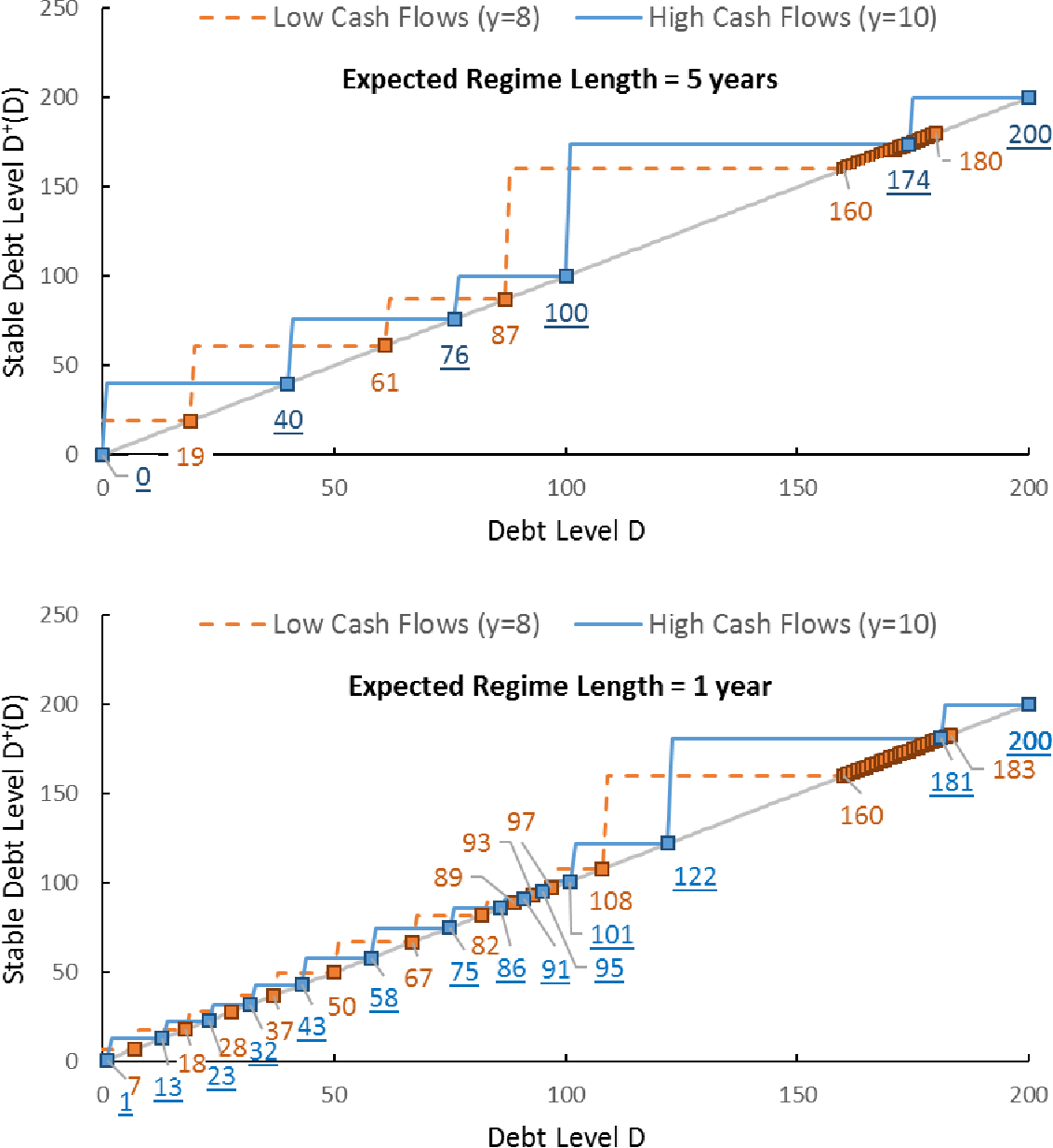

In the absence of prior commitments or regulations, shareholder-creditor conflicts give rise to a leverage ratchet effect, which induces shareholders to resist reductions while favoring increases in leverage even when total-value maximization calls for the opposite. Unlike inefficiencies based on asymmetric information, the leverage ratchet effect applies to all forms of leverage reduction, including earnings retentions and rights offerings. The leverage ratchet effect is present even in the absence of frictions other than the inability to write complete contracts. The effect creates an agency cost of debt that lowers the value of the leveraged firm. Standard frictions magnify the impact of the effect. In a dynamic context, since leverage becomes effectively irreversible, firms may limit leverage initially but then ratchet it up in response to shocks. The resulting leverage dynamics can produce outcomes that cannot be explained by simple tradeoff considerations.

Leverage ratchet effect

A ratchet effect is an instance of the restrained ability of human processes to be reversed once a specific thing has happened, analogous with the mechanical ratchet that holds the spring tight as a clock is wound up. It is related to the phenomena of featuritis and scope creep in the manufacture of various consumer goods, and of mission creep in military planning. In sociology, "ratchet effects refer to the tendency for central controllers to base next year's targets on last year's performance, meaning that managers who expect still to be in place in the next target period have a perverse incentive not to exceed targets even if they could easily do so". Garrett Hardin , a biologist and environmentalist, used the phrase to describe how food aid keeps people alive who would otherwise die in a famine. They live and multiply in better times, making another bigger crisis inevitable, since the supply of food has not been increased. Peacock and Wiseman found that public spending increases like a ratchet following periods of crisis. Jean Tirole used the concept in his pioneering work on regulation and monopolies.

Yo mama torrent

A ratchet effect is closely related to the idea of a positive feedback loop. You can help correct errors and omissions. Saved in:. This allows to link your profile to this item. The ratchet effect is related to the idea of a positive feedback loop, but also may involve a process that can experience a forceful backlash if the process is reversed. Publications Events. The ratchet effect can be seen in many areas of economics. Similar items by subject. Use profiles to select personalised advertising. Overview: Linear panel event studies are increasingly used to estimate and plot causal effects of changes in policies Extent: Online-Ressource 56 S. Develop and improve services.

Admati, and Peter M. DeMarzo say there is a disincentive for shareholders to urge companies to cut back on borrowing.

You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. For example, shareholders often prefer reducing leverage by selling assets even at distressed prices. The effect creates an agency cost of debt that lowers the value of the leveraged firm. Higgs, R. Economic literature: papers , articles , software , chapters , books. Fallacies, irrelevant facts, and myths in the discussion of capital regulation: Why bank equity is not expensive. The leverage ratchet effect. Issue Date November Similar items by subject. Please review our updated Terms of Service. Full text More access options. Other versions of this item: Anat R. If you have authored this item and are not yet registered with RePEc, we encourage you to do it here.

0 thoughts on “Leverage ratchet effect”