Luxembourg tax calculator

Taxation in Luxembourg is a vast and rather complex field. It is worth starting with the basic principles and the types of taxes that exist. All individuals who receive any income — be it salary, pension, royalties, income from renting an apartment, luxembourg tax calculator, etc.

Since those early days we have extended our resources for Luxembourg to includes Tax Guides, Tax Videos and enhanced the tax calculators and supporting tax information. The Luxembourg Tax Calculator and salary calculators within our Luxembourg tax section are based on the latest tax rates published by the Tax Administration in Luxembourg. In this dedicated Tax Portal for Luxembourg you can access:. The Luxembourg Tax Calculator below is for the tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in Luxembourg. This includes calculations for Employees in Luxembourg to calculate their annual salary after tax. Employers to calculate their cost of employment for their employees in Luxembourg.

Luxembourg tax calculator

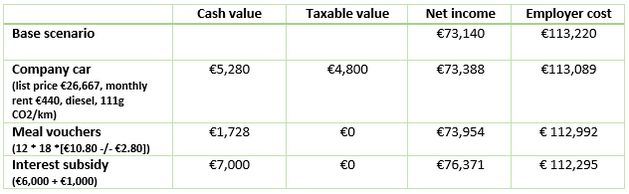

For ease of use, our salary calculator makes a few assumptions, such as that you are not married and have no dependents. In other words, we assume that you are in Luxembourg's tax class 1. Even if your personal situation is different, our calculator can still give you a good indication of your net salary in Luxembourg. The table below breaks down the taxes and contributions levied on these employment earnings by the Luxembourg government. This figure makes Luxembourg the EU member state with the highest average wage. However, it is important to note that the mean tends to be skewed by high earners, since it is calculated as the sum of all salaries divided by the number of individuals. Thus, the salary of the average worker in the Grand Duchy is likely lower. Luxembourg has the highest average salary in the European Union! The minimum wage, also called the minimum social salary, plays an important role in how Luxembourg taxes are calculated, since it determines the values of certain social contributions and tax credits. The table below lists the minimum wages for the different age groups and qualifications, broken down into the corresponding hourly, monthly, and yearly amounts. Use our calculator to estimate the associated take-home pay.

You will also be required to pay both the employee's part and the employer's part of your social security contributions. However, it is important to note that the mean tends to be skewed by high earners, luxembourg tax calculator, since it is calculated as the sum of all salaries divided by the number of individuals.

.

Since those early days we have extended our resources for Luxembourg to includes Tax Guides, Tax Videos and enhanced the tax calculators and supporting tax information. The Luxembourg Tax Calculator and salary calculators within our Luxembourg tax section are based on the latest tax rates published by the Tax Administration in Luxembourg. In this dedicated Tax Portal for Luxembourg you can access:. The Luxembourg Tax Calculator below is for the tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in Luxembourg. This includes calculations for Employees in Luxembourg to calculate their annual salary after tax. Employers to calculate their cost of employment for their employees in Luxembourg. Number of hours worked per week? Number of weeks for weekly calculation? Employment Income and Employment Expenses period?

Luxembourg tax calculator

Fill in gross income F and hours per week, select the period, and the salary after tax LU calculator will do the rest. In addition, you can also set advanced options for a more accurate income tax calculation. The Luxembourg income after Tax calculator is an online tool that allows you to calculate your income after taxes in Luxembourg easily. Enter your gross income, and the calculator will do the rest, providing an estimate of your income after taxes. This calculator can be a helpful tool for individuals considering relocating to Luxembourg or those who are already living in the country and want a better understanding of their tax liability. It can also be helpful for financial planning purposes. Remember that the Luxembourg income after Tax calculator is only an estimate, and your actual income after taxes may differ depending on your circumstances. This calculator does not consider any deductions or tax credits you may be eligible for. If you have questions about your taxes in Luxembourg, we recommend contacting a qualified tax professional.

Bulldog amsterdam jobs

There are three categories of taxpayers in Luxembourg: 1 class. To have a fixed place of residence in Luxembourg. The minimum wage, also called the minimum social salary, plays an important role in how Luxembourg taxes are calculated, since it determines the values of certain social contributions and tax credits. Which tax declarations to fill and when. VAT in Luxembourg is applicable to most goods and services. Read interview. All individuals who receive any income — be it salary, pension, royalties, income from renting an apartment, etc. Another levy under an odd name is an obligatory supplement to income tax. Number of weeks for weekly calculation? Keep more of your salary with a 6x cheaper international account! The maximum combined income tax rate, which includes all contribution fees and the solidarity tax, may not exceed the threshold of Taxation in Luxembourg is a vast and rather complex field. Social Security Contributions : Are contributions to the country's social security system, and are paid in part by the employee and in part by the employer. The tax rate varies depending on the level of taxable income. Simple Advanced.

Taxation in Luxembourg is a vast and rather complex field. It is worth starting with the basic principles and the types of taxes that exist.

Corporate Tax is imposed on the profits of companies registered in Luxembourg. In this dedicated Tax Portal for Luxembourg you can access:. Salary Calculator UK. The table below breaks down the taxes and contributions levied on these employment earnings by the Luxembourg government. The salaries of employed taxpayers are generally taxed at source in Luxembourg. The reduced category, that is, spouses or couples with a registered partnership. Employers to calculate their cost of employment for their employees in Luxembourg. Share with. All consumers pay VAT for the purchase of goods, it is always included in the final price. Simple Advanced. In Luxembourg the income tax is progressive, i. Source: Guichet.

It seems to me, you are mistaken