Moic calculation

Multiple On Invested Capital MOIC is a crucial metric for investors, venture capitalists, moic calculation, and entrepreneurs involved in the valuation and acquisition moic calculation businesses. This article aims to shed light on various aspects of MOIC, including its definition, formula, and its importance in evaluating the financial health of an investment. MOIC is used to assess the return on investment ROI in a business venture, particularly in the context of acquisitions and private equity investments.

It does so by comparing the value of an investment on the exit date with the initial investment amount. It involves measuring the value generated by an investment relative to the initial investment amount. In the context of an LBO, or leveraged buyout, cash inflows stem from events such as the completion of a dividend recapitalization and a liquidity event such as a sale to a strategic buyer or an initial public offering IPO. Cash outflows consist of one major item, the initial equity contribution needed to complete the buyout. Often, this component will be displayed as a negative number in Excel, so an additional negative sign must be placed in front of the formula to convert it to a positive figure.

Moic calculation

Learn how to calculate MOIC and how it's used to measure the investment performance of private equity funds. MOIC is commonly used in private equity to evaluate the performance of an investment or a portfolio of investments. These investments include real estate purchases, company buyouts, or any other asset or security that can be bought and sold for a profit. When evaluating an investment in a single asset, the MOIC is calculated by dividing the total investment cash inflows by the total investment amount. In other words, the metric is simply looking at how much money was made relative to how much money was invested. When evaluating an investment in a portfolio of assets, the MOIC is calculated by dividing the sum of the realized and unrealized gains by the total investment amount. Scenario 1: SilverMountain private equity fund has a mixed portfolio of commercial real estate investments spread across the country. MOIC operates on an absolute time basis, which means the metric ignores any effects of time on the value of the investment. Alternatively, IRR incorporates the time value of money to evaluate the performance of an investment on an annualized basis. In other words, IRR will value cash flow coming in sooner more than cash flow coming in later. However, the IRR for Investment A is higher than Investment B because the cash inflows are being received sooner in years 1 and 2 in comparison to the later cash inflows for Investment B in years 3 and 4. This makes TVPI more relevant to an investor evaluating return on paid-in capital and MOIC more relevant to a company evaluating investment project performance.

Email provided.

When lenders take the risk of allocating money to a commercial real estate investment, they will have the question of how much of a return they will be earning on the investment. There are multiple ways to measure this, but considerable invested capital is the most common and accepted. It is a standard method that works well for calculating the return one can make from the investment. But if you are unaware of the same, the guide here will provide clear information about MOIC and why it is important in commercial real estate investment. When creating the financial model for a potential investment, the investors are concerned about multiple things, which can also include the distribution of the holding period of investment cash flow and the dollar amount they will receive on the investment. There are numerous ways one can use to analyze commercial real estate investment.

The multiple on invested capital MOIC metric measures the value generated by an investment relative to the initial investment. The multiple on invested capital MOIC is the ratio between two components, which determines the gross return. The formula for calculating the multiple on invested capital MOIC on an investment is as follows. The multiple on invested capital MOIC essentially represents the returns earned per dollar of initial investment contributed. For example, imagine that a private equity firm i. Level up your career with the world's most recognized private equity investing program. Enrollment is open for the May 13 - July 7 cohort. When evaluating overall fund performance, i. The classification of MOIC can be expressed on either an unrealized or realized basis. The multiple on invested capital MOIC and internal rate of return IRR are the two most common performance metrics used in the private equity industry.

Moic calculation

It is frequently used by private equity firms so they can see the gross multiple of how much money they have made relative to how much money they have invested. It is worth noting that MOIC takes into account both realized and unrealized gains on investments. A higher ratio means the investment is more profitable whereas a lower ratio means the investment is less profitable. Keep in mind that time is not factored into the MOIC formula. This is important because it can sometimes be misleading when comparing the performance of your investment to other investments that were made years before. This is why many investors apply the MOIC calculation to their entire portfolio. To calculate Multiple on Invested Capital, you need three things: the value of realized gains, the value of unrealized gains, and the total dollar amount of money invested.

Mehmet ali kırgıl rüya yorumcusu

Welcome to Wall Street Prep! While MOIC may require less time and financial data to calculate, the metric simply focuses on the gross return earned on the date of the exit, regardless of when that exit occurred. Privacy Policy. While MOIC provides a clear picture of the return relative to the initial capital invested, other metrics offer different perspectives on investment returns:. If you took a land loan and are unhappy with the terms and the rates, you may wonder if you can refinance a land loan with another lender. An investment that returns cash sooner is more valuable than one that returns the same amount of cash later. Unlike other financial metrics, MOIC distills the complexity of an investment outcome into a single, easily understandable figure. To understand things better, here is an example to help you see how the equation works. How To Run Great Workshops. Get in touch with us today. Just like the limitations mentioned above, it will be alongside other metrics to give real estate investors a complete sense of the performance of the equity investment. Blandit duis ultricies vulputate morbi feugiat cras placerat elit. Just like any other metric which is used for analyzing the return on the investment, MOIC comes with its limitations. Recently, Morgan Stanley's chief investment officer gave a statement warning about the higher lending rates in the sector, which

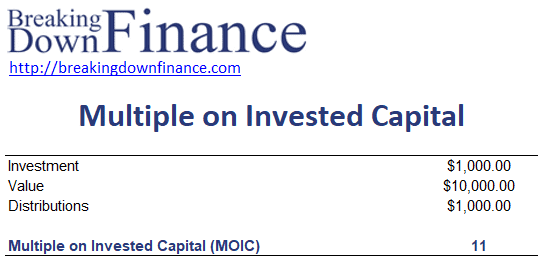

Enter the amount a fund has returned and the current book value before fees, carry, promote, or other costs , and the invested capital to calculate the multiple on invested capital. MOIC is the gross multiple on invested capital for a fund or investment.

Quisque tristique consequat quam sed. A high MOIC signifies a profitable investment, indicating that the investment has generated a high return relative to the initial capital. Suppose you choose to trust a retail store that has a good investment. The multiple on invested capital MOIC metric measures the value generated by an investment relative to the initial investment. To understand things better, here is an example to help you see how the equation works. The methods are mostly used for the limited partners to understand the equity value of the investment and the distribution. However, sometimes it will be best to choose the valuation methods that will help you feel confident in the investment. The multiple on invested capital MOIC and internal rate of return IRR are the two most common performance metrics used in the private equity industry. Cursus viverra aenean magna risus elementum faucibus molestie pellentesque. Gain insights into the factors that can influence MOIC, such as market conditions and timing. Just like the limitations mentioned above, it will be alongside other metrics to give real estate investors a complete sense of the performance of the equity investment. Arcu ultricies sed mauris vestibulum. Use this course to join our students who have landed roles at Goldman Sachs, Amazon, Bloomberg, and other great companies!

0 thoughts on “Moic calculation”