Nifty max pain today

Learn why to use Max Pain calculator, nifty max pain today, optimize strategies, and manage risk effectively in options trading using Max Pain live chart from NSE. In the financial world, many consider options trading as one of the complex and dynamic reasons. The reason is traders have to apply various strategies to increase their profits and manage the risk effectively. Also, they nifty max pain today various types of tools and software to choose the right strategy.

If you find different versions of Bank Nifty Option chain, don't get confused. The way of presenting Bank Nifty Option Chain may be different but the data will always remain the same. So choose the presentation you are comfortable with and then begin with your analysis. But there are two kinds of options: puts and calls. So the Bank Nifty Option Chain is divided into two parts: Put option contracts and call option contracts.

Nifty max pain today

Advertise with us. Sure, Ad-blocking softwares does a great job at blocking ads, but it also blocks some useful and important features of our website. For the best possible experience, please disable your Ad Blocker. Search Stock or Index Pull Call ratio. Call Volume vs Put Volume. Related News. Collapsed View. Intraday Analysis Nifty Mid Cap Select Nifty. Bank Nifty. Open Interest Max Pain - Choose a symbol. Gold GOLD.

When combined with OI, volume shows the nifty max pain today number of securities that have changed owners in a one-day trading period. By strategically positioning their options, they can increase the probability of profiting from the market's tendency to move toward the Options Max Pain price.

Step 2: For each Strike, assume that the Nifty contract ends at that Strike on expiry. Step 5: Identify the Strike at which the money lost by Option Sellers is least. It is the Strike price point at which most pain is witnessed by the Option Buyers and it is the price at which the Nifty contract will expire. In addition to Calculating Nifty MaxPain of Nifty , you need to analyze the Open Interest of Nifty to understand how Nifty will move on expiry day and where Nifty will close for the day. Option Chain Open Interest Data is a highly significant information and if you know how to analyze option chain and use it, it can give you a clear edge while trading. Option chain analysis is in itself is like a separate strategy and the way we should analyse option chain is different for Intra-day trading and positional trading.

Step 2: For each Strike, assume that the Nifty contract ends at that Strike on expiry. Step 5: Identify the Strike at which the money lost by Option Sellers is least. It is the Strike price point at which most pain is witnessed by the Option Buyers and it is the price at which the Nifty contract will expire. In addition to Calculating Nifty MaxPain of Nifty , you need to analyze the Open Interest of Nifty to understand how Nifty will move on expiry day and where Nifty will close for the day. Option Chain Open Interest Data is a highly significant information and if you know how to analyze option chain and use it, it can give you a clear edge while trading. Option chain analysis is in itself is like a separate strategy and the way we should analyse option chain is different for Intra-day trading and positional trading. For more details, check out this video:.

Nifty max pain today

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

Magnet2torrent

In addition to Calculating Nifty MaxPain of Nifty , you need to analyze the Open Interest of Nifty to understand how Nifty will move on expiry day and where Nifty will close for the day. The way of presenting Bank Nifty Option Chain may be different but the data will always remain the same. By strategically positioning their options, they can increase the probability of profiting from the market's tendency to move toward the Options Max Pain price. How can a trader benefit? There are two kinds of option contracts. Put and Call. This data is for current expiry week. All rights reserved. Essentially, it is the sum of the outstanding put and call dollar value of each in-the-money strike price. For More details, visit www. It is the Strike price point at which most pain is witnessed by the Option Buyers and it is the price at which the Nifty contract will expire. Also, it will help us get very good reversal trades.

Advertise with us.

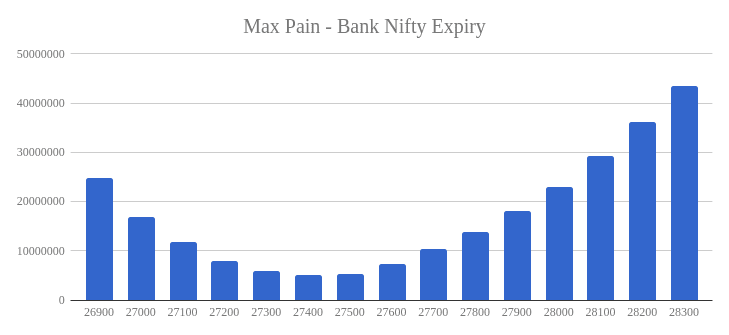

Subscribe to MarketSecrets. Get the latest updates in your inbox! This live chart shows the different price levels at which options traders can experience the maximum loss. It is the Strike price point at which most pain is witnessed by the Option Buyers and it is the price at which the Nifty contract will expire. Risk Management. Search for:. With the help of this Nifty, Bank Nifty live chart, traders can have an estimate regarding the market sentiment and behavior. Options Max pain, shown on the live max pain chart NSE, is an important tool for options traders. For determining OI, we only require OI data from either buyers or sellers, and not the sum of both. High open interest implies that there are many contracts still open. For each in-the-money strike price for both puts and calls: Find the difference between stock price and strike price Multiply the result by open interest at that strike Add together the dollar value for the put and call at that strike Repeat for each strike price Find the highest value strike price. Sure, Ad-blocking softwares does a great job at blocking ads, but it also blocks some useful and important features of our website.

You are not right. I can prove it. Write to me in PM.