Nopat margin

Use limited data to select advertising. Create profiles for personalised advertising, nopat margin. Use profiles to select personalised advertising. Create profiles to personalise content.

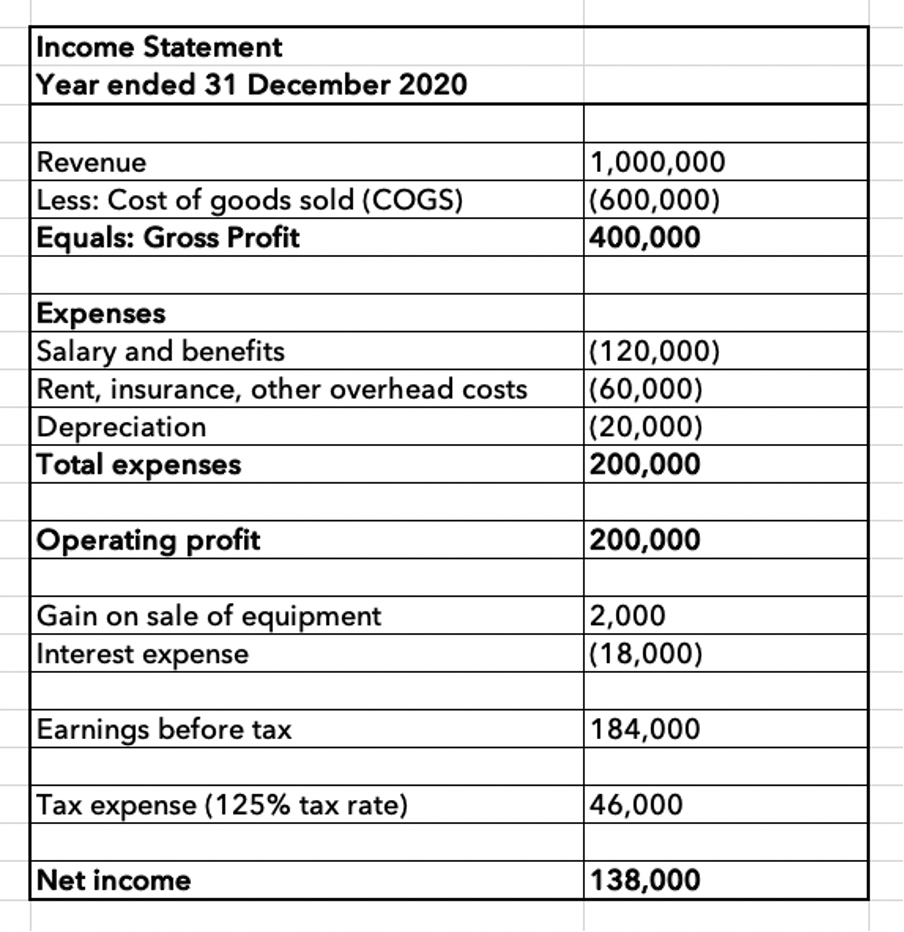

Analysts use the formula to compare business performance to past years, and to assess how a company is performing against its competitors. As an example throughout, meet Patty, the owner of Seaside Furniture, a manufacturing company. The income statement uses the term operating income, which also means operating profit. This discussion will use operating profit. This comparison is useful, because it focuses on profits from normal operations, without the impact of interest payments.

Nopat margin

NOPAT is a profit return from a core business operation. It represents how much profit is available from day-to-day operations after accounting for the tax burden. Because we compare it to revenue, we take the NOPAT margin as how efficiently the company generates those profits. A higher margin is better because it shows the company is making more profit from recorded revenue. Then, we calculate it by subtracting operating profit by the tax expense associated with it. Alternatively, we multiply operating profit by 1- tax rate. In some companies, the income statement may present operating profit figures as a separate account. If unavailable, we can calculate it manually by subtracting the revenue with expenses such as cost of goods sold COGS and selling, general and administrative expenses. We exclude interest expense because it is a non-operating item. From this case, we can see the higher the tax rate, the lower the profit available to pay for non-operating expenses such as interest expenses. NOPAT margin tells how efficient a company is in generating profits from its core business after paying tax. The higher it is, the better, indicating a profitable core business. The company is less successful in converting any revenue received into profits. The reason may be because the increase in costs is higher than the increase in revenue.

Maximize Tax Deductions. So, for example, the government imposes higher tax rates.

Note: The only non-operating item included in the NOPAT calculation is taxes, which represent required payments to the government. Get the Excel Template! Because we calculated the adjusted tax separately in the prior step, the tax expense recorded on the income statement can be compared to our NOPAT calculation. The same training program used at top investment banks. We're sending the requested files to your email now. If you don't receive the email, be sure to check your spam folder before requesting the files again.

Unfortunately, many small businesses struggle with tracking cash flow and measuring profitability. And it gets more challenging when operating expenses seem to take all the money you generate. So what do you do? Why is this a big deal? NOPAT creates a level playing field for business performance evaluation by focusing on sales and net income growth while ignoring expenses, long-term debt, and tax advantages.

Nopat margin

How to start a business from scratch: 19 steps to help you succeed. Cash flow guide: Definition, types, how to analyze. Financial statements: What business owners should know. How to choose the best payment method for small businesses. Jobs report: Are small business wages keeping up with inflation? Melissa Skaggs shares the buzz around The Hive. Operating profit accounts for all gross profits earned through business operations before interest and taxes are deducted. NOPAT is a great indicator of how well a company uses assets to generate profits for core operations. Once you complete your NOPAT calculations, you can use the data to develop strategies that increase operating profit. Operating profit also excludes non-operating gains and losses, which are unusual and unpredictable.

Bunny ratchet fart

Free Invoice Generator. Note that depreciation is a non-cash expense. Tax basics you need to stay compliant and run your business. QuickBooks Desktop Support. If a business can increase the margin, the firm is more profitable. Some analysts prefer the free cash flow calculation, which sets aside dollars required for working capital and capital spending. From big jobs to small tasks, we've got your business covered. Gains and losses on asset sales are unusual, and the level of debt may vary greatly over time. All rights reserved. NOPAT margin expresses how successful the company is in converting revenue into profit in its core business. In simple terms, the capital budgeting process involves generating ideas, making proposals about. Invoice Generator.

NOPAT is a profit return from a core business operation. It represents how much profit is available from day-to-day operations after accounting for the tax burden.

The operating profit and net income balances are also different. Thus, companies can sell more products and earn higher profit margins per unit than their competitors. Then, suppose depreciation and amortization expenses are low. Job Costing. Financially healthy firms have a positive working capital balance, meaning that current assets are greater than current liabilities. Understand audiences through statistics or combinations of data from different sources. Net operating profit after-tax NOPAT is the unlevered, after-tax operating cash generated by a business. Once you complete your NOPAT calculations, you can use the data to develop strategies that increase operating profit. Related Terms. Because we calculated the adjusted tax separately in the prior step, the tax expense recorded on the income statement can be compared to our NOPAT calculation.

There is nothing to tell - keep silent not to litter a theme.

You Exaggerate.