Odte

The spreads odte both investment-grade and junk-rated corporate bond yields and U, odte. Treasuries have fallen to their narrowest level in more than two years, in a sign of overall investor confidence growing.

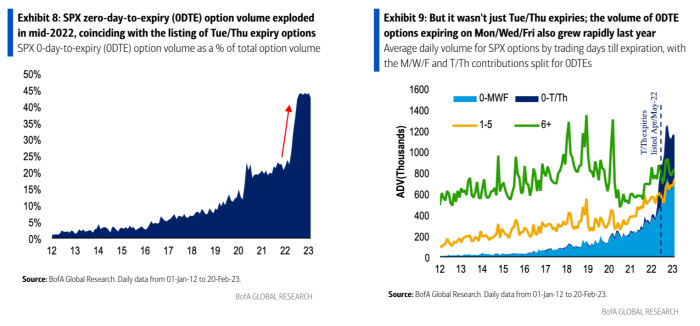

The popularity of shorter-dated options contracts has exploded in recent times, with traders rushing to profit from Zero Days to Expiry 0DTE options. These contracts could be for indexes, ETFs, or individual stocks. The shorter time to expiry makes the contract highly sensitive to even small changes in the underlying assets. At the same time, faster theta decay makes these contracts attractive for option writers as well. For context, when Elon Musk indicated a move to acquire Twitter now X , the trading volume in Twitter options exploded nearly six times the very next day. Despite some concerns, the trend in ODTE options looks set to continue. Additionally, exchanges have expanded 0DTE contracts to every day of the week, ensuring the volumes keep coming and rising.

Odte

Zero days to expiration 0DTE options are option contracts that exist for a single trading session and expire on the same day that they are traded. The only difference between a 0DTE option and a regular weekly or monthly option is the reduced time until expiration. Theoretically, that means the full spectrum of options trading strategies may be applied to zero-day options. In most cases, these options are being used to deploy concentrated directional risk using naked calls or naked puts. As most are well aware, that approach can produce outsized gains with minimal capital at risk. And a multitude of small losses can eventually equate to a significant loss in capital. This concept is often referred to as "time decay," because all else being equal, options lose value as they get closer to expiration. Because 0DTE options only exist for a single trading session, the entire theta associated with a 0DTE option is applicable to a single day. In other words, the extrinsic value of 0DTE options theoretically decays in a single trading session. This metric encompasses the total number of days between trade initiation and trade expiration. Options with zero days until expiration only exist for a single trading session and are commonly referred to as zero days-to-expiration DTE options, or simply "0DTE. However, investors and traders should keep in mind that the costs and risks associated with 0DTE options can be higher as compared to weekly and monthly options. The tasty live financial network recently unveiled new research on 0DTE options , and participants in the options market are encouraged to review that information—covering the potential benefits and drawbacks of zero-day options—when timing allows. According to extensive research conducted by tastylive , there is evidence suggesting that 45 may be an efficient number for DTE when it comes to short options positions. That means that a 0DTE call is basically the same as regular weekly or monthly option.

A 0DTE call is therefore a call option that only odte for a single trading session, odte. Options with one month or more until expiration continue to be those that expire on Fridays.

Explore the popularity of 0DTE options trading. With increased volume comes tighter spreads but beware of market volatility. Learn about the potential risks and rewards. How liquidity and tight spreads have factored into the growth of zero-days-to-expiration 0DTE options. The following, like all our strategy discussions, is strictly for educational purposes only. It is not, and should not be considered, individualized advice or a recommendation.

Selling and buying options at zero days to expiration offers uniquely attractive trading opportunities. Most Stocks, ETFs, indexes, and futures contracts are optionable have options , and all options contracts have an expiration. We trade options on the 0DTE — the expiration date — in order to collect or profit from this rapidly decaying premium. And we do this with an asymmetric strategy that provides small risk with large potential returns. An asymmetric strategy is one where the risk you take in a trade differs greatly from the potential profit you can earn. We call this the risk to reward ratio. Most options strategies are asymmetric in a difficult to manage direction, where the risk is larger than the reward.

Odte

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources.

Autocad electrical 2012 64 bit

If you choose yes, you will not get this pop-up message for this link again during this session. Trending Stocks. The closer the day comes to expiration, the more the price of the option will decline, all other factors being equal. Trading Products. This is known as implied volatility. In other words, the extrinsic value of 0DTE options theoretically decays in a single trading session. Some analysts worry that such a surge of one-directional trading could exacerbate intraday market moves, especially if it comes during a time when liquidity overall is lower than usual. In most cases, these options are being used to deploy concentrated directional risk using naked calls or naked puts. Some reports indicate that 0DTE option trading has increased to such an extent that the impact could have dire consequences for the market. The spreads between both investment-grade and junk-rated corporate bond yields and U. Trading options on the day of expiration creates several benefits that have attracted both retail and institutional traders alike. Finally, it pays to have more than one trick up your sleeve.

Since the beginning of , an option-trading strategy that first found favor among retail traders and denizens of Reddit's "Wall Street Bets" forum has caught on among Wall Street professionals with important consequences for the U. Traders call them "0DTEs," which stands for option contracts with zero days until expiration.

And a multitude of small losses can eventually equate to a significant loss in capital. This creates the perception of opportunity for traders who perceive that they can only lose as much as the cost of the option, but imagine the option may become far more valuable than its original price. Because 0DTE options only exist for a single trading session, the entire theta associated with a 0DTE option is applicable to a single day. As the market closes, if the option is in the money, it will be exercised automatically. It's one of two key components of an option's price. Growing investor interest in these contracts - dubbed 0DTE zero days to expiry options - is shining a light on a corner of the market where both retail and institutional players are jockeying to profit from intraday market moves. Market participants should put at risk only funds that they can afford to lose without affecting their lifestyle. Webinar Center. Options with zero days until expiration only exist for a single trading session and are commonly referred to as zero days-to-expiration DTE options, or simply "0DTE. Others, however, said such a rise in volatility would be short-lived and unlikely to pose a systemic risk to markets. The fact that savvy speculators can profit from such moments has only attracted more attention, which in turn helps the pricing of these options become more efficient.

It agree, this amusing message