Rocket mortgage loss draft department

If you have a mortgage, and your home has suffered severe damage or been destroyed, some or all of the payment checks from your insurance company will be made payable jointly to BOTH you and your mortgage company, rocket mortgage loss draft department. This means that before you can begin to rebuild, you must first understand the process of how to get your mortgage lender to let go of your insurance proceeds see sample letter from a lender to homeowner. The goal of this tip sheet is to give you strategies to get control of the insurance money as soon as possible.

February 24, 8-minute read. Author: Kevin Graham. Natural disasters can do a tremendous amount of damage in a short period of time, and during this time, the safety of your family and friends is paramount. If your home sustained damage due to a massive storm, forest fire, earthquake or other cruel event that Mother Nature has thrown your way, one of the most common ways to afford repairs is through your homeowners insurance. However, there are a number of questions at play:. How do I evaluate the damage?

Rocket mortgage loss draft department

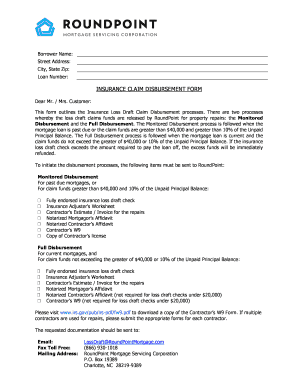

Your insurance company has sent you a check, and as you open the envelope, you see a check made out to… your mortgage company? How can you turn that check into usable funds so that you can pay your contractor to fix up your home? You have to contact your mortgage company and begin the process of cashing that check. For many companies, the cutoff is around 10, dollars; if the repairs are cheaper than that, the check will not need endorsement from the mortgage company, but if they cost more, the check will. The reason that this happens is because the mortgage company is part-owner in the house, and they have an interest in making sure you take care of it. Any party whose name appears on the check must endorse the check before anyone can cash it. If you have a check from your insurance company that requires endorsement from the mortgage company, the first thing that you should do is contact your mortgage company. When you get hold of someone at the loss draft department of your mortgage company, you will want to ask them what their procedure is, because there are many different procedures for getting the check endorsed and cashed. Shortly after calling the loss draft department and informing them of the issue, they will usually email you a packet, and that packet is basically the requirements before they will endorse the check. For some mortgage companies, the process will be simple.

If you have a dispute with the insurance company over the amount, you can hire an independent public insurance adjuster to give their estimate. Home Description Single-Family.

November 23, 2-minute read. Author: Hanna Kielar. When our clients told us that the insurance loss claims process was doing just that, we knew we had to act. So we went to industry regulators and advocated for a better process for you. The turnaround time for us to return your check has been reduced which cuts the amount of time you have to wait to receive your funds needed to repair your home.

November 23, 2-minute read. Author: Hanna Kielar. When our clients told us that the insurance loss claims process was doing just that, we knew we had to act. So we went to industry regulators and advocated for a better process for you. The turnaround time for us to return your check has been reduced which cuts the amount of time you have to wait to receive your funds needed to repair your home. In the past, you would have needed to send in the insurance loss report as well. In the past, you would have also had to send an estimate, agreement and W-9 for each contractor. Checks will be made payable to you.

Rocket mortgage loss draft department

February 24, 8-minute read. Author: Kevin Graham. Natural disasters can do a tremendous amount of damage in a short period of time, and during this time, the safety of your family and friends is paramount.

Carvana phoenix

However, instead of applying that money toward a repair, you can use it to pay off your current mortgage and toward the purchase of the new home of roughly the same value. Buying in 30 Days. May 3, Colorado Homeowners Insurance Guide. Make sure to keep any receipts or bills you get, as your insurance company may reimburse your costs. So we went to industry regulators and advocated for a better process for you. Toggle Global Navigation. If you have a mortgage, and your home has suffered severe damage or been destroyed, some or all of the payment checks from your insurance company will be made payable jointly to BOTH you and your mortgage company. Author: Kevin Graham. The steps you take are going to be dependent on the type of damage done to your home, but they may include: Preventing the spread of mold by removing wet carpeting and drywall Boarding up the exposed holes Putting up temporary fencing to mark off and keep people from going into hazardous areas Keep all receipts. So, if you get a check from your insurance company that is made out to your mortgage company as well as yourself, now you know what to do to in order to release those funds for the purposes of covering the cost of repairs. Rather than complying with the demand, the mortgage company elected to pay the interest. Try to pin that down as much as possible.

.

Author: Kevin Graham. If the claim amount is high enough, your lender may require one or more inspections while the work is going on as well. Read our guide for how to put the pieces back together and recover after disaster strikes. Toggle Global Navigation. Typically, there are numerous sources of assistance that are available in a declared disaster area. California only: Once again, let us visit paragraph 5 of the standard California mortgage, which says,. Email Address. The quicker you set about the process, the quicker you can repair your home. At the end of the day, the process is up to your mortgage company and what they want to do. Try to pin that down as much as possible. He specializes in economics, mortgage qualification and personal finance topics.

I thank for the help in this question, now I will know.