Spyi

Get our overall rating based on a fundamental assessment of the pillars below, spyi.

From 3 rd April , the TER on this fund will be reduced to 0. Please refer to the shareholder notice issued on 20 th March Equity securities may fluctuate in value in response to the activities of individual companies and general market and economic conditions. ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage commissions and ETF expenses will reduce returns. Investing in foreign domiciled securities may involve risk of capital loss from unfavorable fluctuation in currency values, withholding taxes, from differences in generally accepted accounting principles or from economic or political instability in other nations.

Spyi

The Fund seeks to generate high monthly income in a tax efficient manner with the potential for equity appreciation in rising markets. This browser is no longer supported at MarketWatch. For the best MarketWatch. Market Data. Latest News All Times Eastern scroll up scroll down. What can I do? Should we sell or rent it out? Search Ticker. SPYI U. Last Updated: Feb 23, p. EST Delayed quote. After Hours Volume: Volume: Customize MarketWatch Have Watchlists?

Log in to see them here or sign up to get started.

SPYI may be considered as an alternative to existing core equity allocations, and seeks to provide a tax efficient monthly income stream, while maintaining the opportunity for upside participation when market conditions warrant. Past performance is no guarantee of future results. The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

SPYI may be considered as an alternative to existing core equity allocations, and seeks to provide a tax efficient monthly income stream, while maintaining the opportunity for upside participation when market conditions warrant. Past performance is no guarantee of future results. The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. For performance data current to the most recent month end, please call Brokerage commissions will reduce returns. Market Price returns are based upon the official closing price on the listing exchange NYSE at p. SPYI - Form — 5. High Monthly Income.

Spyi

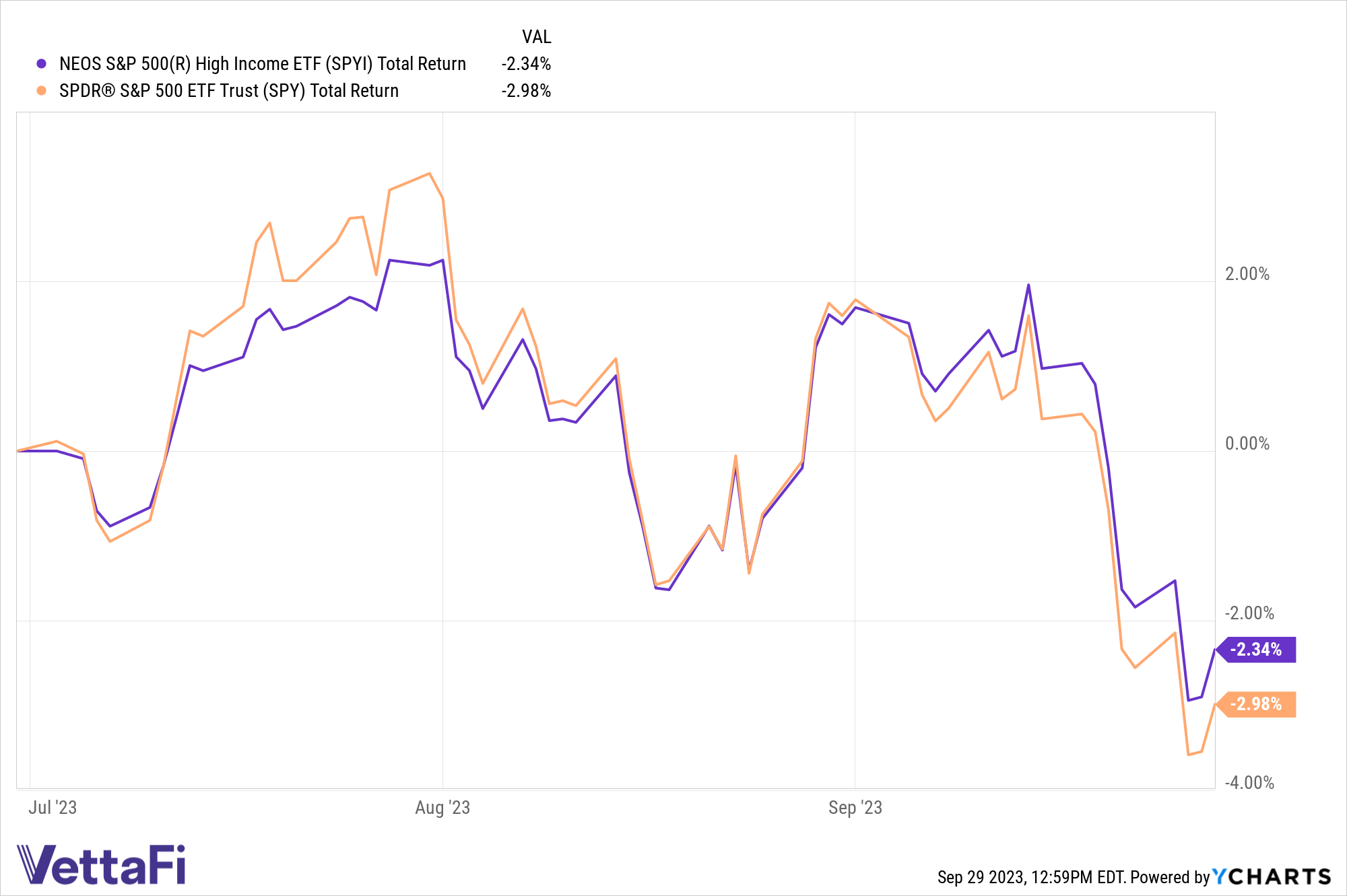

The adjacent table gives investors an individual Realtime Rating for SPYI on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating. Compare Category Report. This section shows how this ETF has performed relative to its peers. Returns over 1 year are annualized.

Ayla woodruff nudes

The recipient is only permitted to view or receive the Index Data in the form in which it is in presented. Search the FT Search. The Fund seeks to generate high monthly income in a tax efficient manner with the potential for equity appreciation in rising markets. Distribution Yield Show more US link US. Form — Report of Organizational Actions Affecting Basis of Securities To facilitate tax basis reporting, since January , the Internal Revenue Service has required certain securities activity to be reported on Form Stoxx Create Watchlist …or learn more. Communication Services. Base Fund Currency. Process Pillar.

The Fund seeks to generate high monthly income in a tax efficient manner with the potential for equity appreciation in rising markets. This browser is no longer supported at MarketWatch.

Distribution Yield Access Premium Tools. Small Blend ETFs. Ultrashort Bond ETFs. Asset type. Per cent of portfolio in top 5 holdings: Alphabet Inc. This browser is no longer supported at MarketWatch. No warranty is provided as to the accuracy of reference NAVs. Base Fund Currency. Non-US stock. All ETFs by Classification.

As it is impossible by the way.