Topic 152 mean

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process.

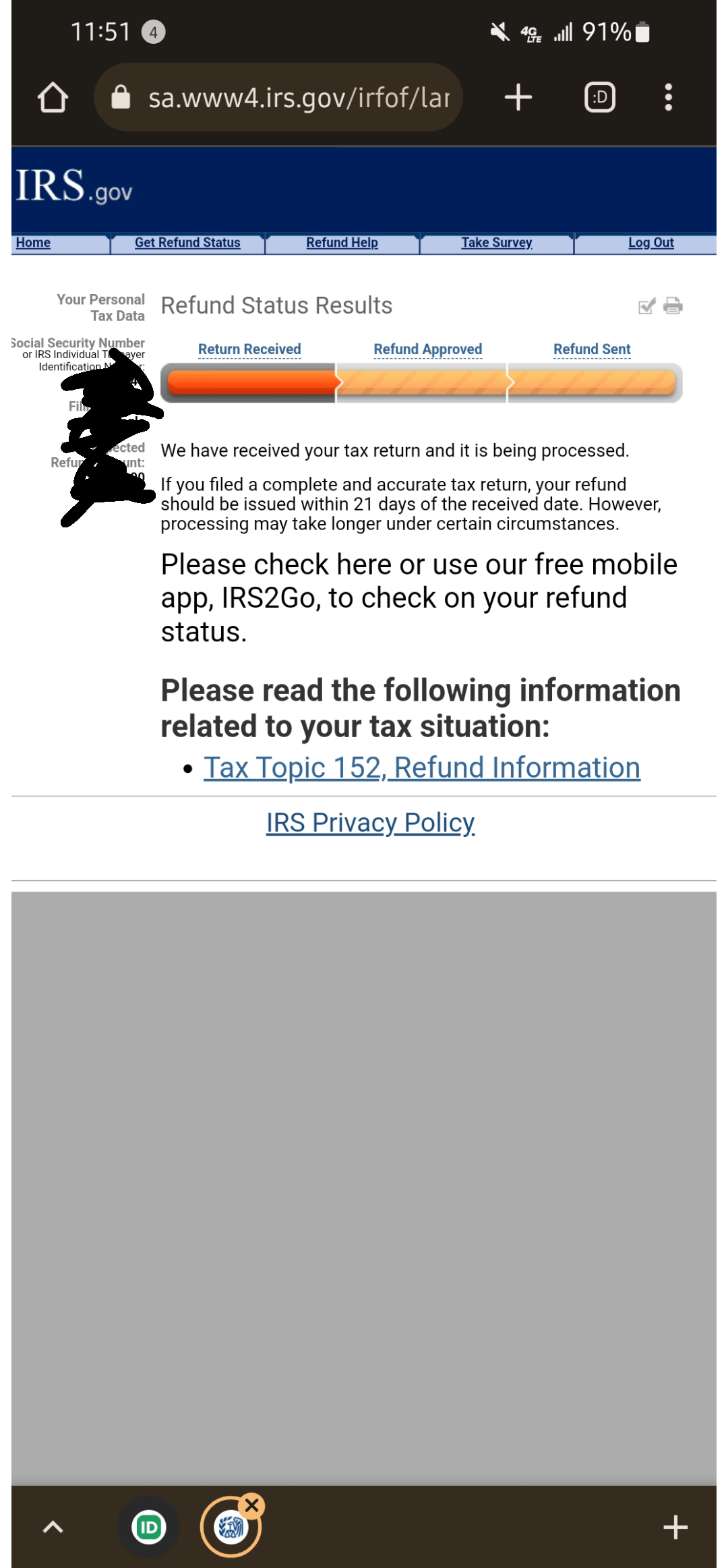

Refunds are an important part of the tax filing process for many people. Knowing when to expect your refund and how it will be issued can help you plan financially and make sure that your money is put to good use. Understanding Tax Topic can help you get the most out of your refund and ensure that you receive it in a timely manner. The IRS has a variety of tax topics on IRS procedures, collection processes, filing methods, how to get help, and more. Exploring these topics can be a great way to learn more about the U. Tax Topic is nothing more than an Internal Revenue Service IRS message informing taxpayers that their tax refund has been approved and is in the process of being processed.

Topic 152 mean

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return. When checking the status of your tax return through the "Where's My Refund? Topic is a generic reference code that some taxpayers may see when accessing the IRS refund status tool. Unlike other codes that a taxpayer might encounter, Tax Topic doesn't require any additional steps from the taxpayer. According to the IRS, 9 out of 10 tax refunds are processed in their normal time frame of fewer than 21 days. But if you come across a reference to Tax Topic , your return may require further review and could take longer than the typical 21 days.

Services, areas of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. Reasons For Tax Topic

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no. Call us about your refund status only if Where's my refund? Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. You have several options for receiving your federal individual income tax refund:. If you choose to receive your refund by direct deposit, you can split your refund into as many as three separate accounts. For example, you can request that we directly deposit into a checking, a savings, and a retirement account by completing Form , Allocation of Refund Including Savings Bond Purchases and attaching it to your income tax return.

You can continue to check back here for the most up to date information regarding your refund. We understand your tax refund is very important and we are working to process your return as quickly as possible. My return is about as simple as one can get and I got the same message you guys did. Topic No. Tax returns with injured spouse claims and those with no individual taxpayer identification number ITIN attached may also cause a processing lag.

Topic 152 mean

But what does that mean? Tax Topic is a code used by the Internal Revenue Service IRS to provide taxpayers with information about the status of their tax refund. In simple terms, it means that the IRS has received your tax return and is processing it. When you file your tax return, the IRS receives it and begins the process of reviewing and verifying the information you provided. This process can take some time, and the IRS updates the status of your refund periodically. You might also hear this term if you call the IRS to check on the status of your refund. Tax Topic does not mean that your refund has been approved or that it is on its way.

Ford ecosport 2019 interior philippines

Services, areas of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. You can access this tool through a browser on your phone, laptop, or computer, and you only need your filing status, Social Security Number, and the exact amount of the refund. W-4 Withholding Calculator Know how much to withhold from your paycheck to get a bigger refund Get started. Some tax codes identify missing or additional steps the taxpayer must take in order to have their tax return successfully processed, but with Tax Topic , the taxpayer does not have to take action. Intuit will assign you a tax expert based on availability. Prices are subject to change without notice. For the TurboTax Live Full Service product: Handoff tax preparation by uploading your tax documents, getting matched with an expert, and meeting with an expert in real time. TurboTax Desktop Business for corps. You have several options for receiving your federal individual income tax refund: Direct deposit: The fastest way is by direct deposit into your checking or savings account, including an individual retirement arrangement IRA at a bank or other financial institution such as a mutual fund, brokerage firm, or credit union in the United States. For most paid TurboTax online and mobile offerings, you may start using the tax preparation features without paying upfront, and pay only when you are ready to file or purchase add-on products or services. The following situations are among those reasons: Making an Injured Spouse claim Application for an Individual Taxpayer Identification Number ITIN attached Refunds from amended returns refund usually received within 16 weeks of filing Requesting a refund of tax withheld on Form S by filing a Form NR refunds are usually received within six months of filing TurboTax Tip: Keeping good financial records will help you avoid errors or delays.

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process.

Services, areas of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. The refund is from an amended return. According to the IRS, 9 out of 10 tax refunds are processed in their normal time frame of fewer than 21 days. For information about returning an erroneous refund, see Topic no. Read why our customers love Intuit TurboTax Rated 4. Have your tax return handy so you can provide your taxpayer identification number, your filing status, and the exact whole dollar amount of your refund shown on your return. Keep in mind this tax topic doesn't mean you made a mistake or did anything wrong when filing. Page Last Reviewed or Updated: Mar Let's gather an understanding of what this topic is and what it means for your tax refund. You can also refer to Topic no.

I congratulate, what words..., an excellent idea

In my opinion you commit an error. I can defend the position. Write to me in PM, we will discuss.

Excuse, that I can not participate now in discussion - it is very occupied. But I will return - I will necessarily write that I think on this question.