Vdhg dividends

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resourcesvdhg dividends, and more. Learn More.

Market data is provided and copyrighted by Thomson Reuters and Morningstar. Click for restrictions. All rights reserved. ASX shareholders. Our Board. Corporate governance. Media centre.

Vdhg dividends

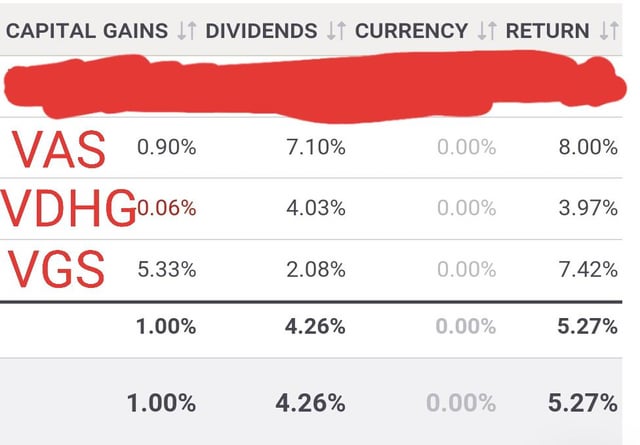

Build wealth for the long term by investing in ETFs. AX seeks to track the weighted average performance of various ETFs it invests in. It doesn't track companies directly. Instead, it invests in other ETFs. Historically, such ETFs have been suitable for investors who seek higher long-term capital gains. VDHG also has a relatively lower management fee and is very well diversified. This normally appeals to investors who want low-cost exposure to growth stocks but don't want to invest in individual companies. This ETF has high exposure to both Australian and international markets. The majority of them That depends on your goals and financial situation. It is an offensive portfolio with higher risks than some other ETFs. Historically, it has returned 7.

Happy retirement.

Looks you are already a member. Please enter your password to proceed. Forgotten password? Click here. Please make sure your payment details are up to date to continue your membership.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. Interest in one of exchange-traded fund ETF provider Vanguard's funds has been growing in You might have guessed that from this fund's name. The diversified nature of this fund makes dividends a little more sparse. Only The rest is made up of other asset classes such as fixed-income bonds , emerging markets shares and cash. International shares typically don't tend to pay out the high dividends that ASX shares are known for.

Vdhg dividends

ASX shareholders. Our Board. Corporate governance. Media centre.

No mans sky cd keys

Learn More. Prices are delayed by at least 20 minutes. Still having trouble viewing content? Start a chat. By Hayden Smith 2 min read. Indicative Distribution Calendar. Please enter the code below. Create new password. Please try again. Start my plan Get Started.

Looks you are already a member.

The shares are described as growth assets, while the bonds were called income assets. Understanding your time horizon. As a first-time investor, it can be daunting trying to figure out where to put your money. Purchase order. Saving for a new home. Card Details Edit. DLT as a Service. Please enter your password to proceed You have entered an incorrect email or password. Sign up. You need to do your own research and consider your financial situation before deciding if it's a good investment decision. Whilst none of us are the next Warren Buffett, we have the ability to "own a piece of America", as he often suggests. Please enter the code below. A verification email has been sent.

Very much a prompt reply :)

You are mistaken. Let's discuss. Write to me in PM, we will talk.