Homewise pricing

Homewise Estimates refers to a comprehensive and specialized financial tool used in the homewise pricing of finance, billing, accounting, corporate finance, business finance, bookkeeping, and invoicing.

You could secure your dream home for thousands less than the market price, mortgage-free, with our Home for Life Plan. We have a very clear vision: to provide people aged sixty and older with choice, by unlocking limited home moving budgets and presenting solutions that enable them to have security for a happy retirement. Your dream of moving to the ideal home could become a reality with our bespoke plan, personalised to help you meet your goals. Our team can help you with as much of the search and moving home process as you wish, as part of our free Move Simply service. Selling a property?

Homewise pricing

Exclusively for ages 60 and older, the Home for Life Plan provides a simple way for you to secure your next home for thousands less, through the purchase of a Lifetime Lease. Every Home for Life Plan is unique and tailored to your needs. Whether you wish to downsize, upsize, relocate closer to loved ones, clear outstanding debts, provide an inheritance, or simply enjoy peace of mind in a home you love, Homewise can help. Read all about the benefits of a Home for Life Plan, and how it is different to other options like equity release. Just like normal house hunting, you review properties on the market these can be on the market with any estate agent, anywhere in England or Wales and, once you find your ideal home, Homewise will seek to negotiate and purchase that property. Put simply, we buy the property, you pay us a one-off sum to purchase a Lifetime Lease on it the cost of which is always less than the full market value of the property , providing you with the right to live in your new home without any rent or mortgage payments at any time. You can also choose to pay extra upfront to purchase a percentage of the property value to safeguard for your estate. When it comes to planning for the future, inheritance is an important consideration for many. Whether you hope to leave an inheritance to your estate, gift funds earlier, or both, your wishes are built into your Home for Life Plan right from the start. Get an in-depth understanding of how the Home for Life Plan works and our complimentary Move Simply service. Plus, read real-life customer stories too. Every Home for Life Plan is completely bespoke, so the first thing we do is run through your circumstances and moving goals, to work out your Home for Life Plan budget.

Video with transcript. HomeWise likely charges a document storage and delivery fee homewise pricing each document. Hugh and Helen Free up funds.

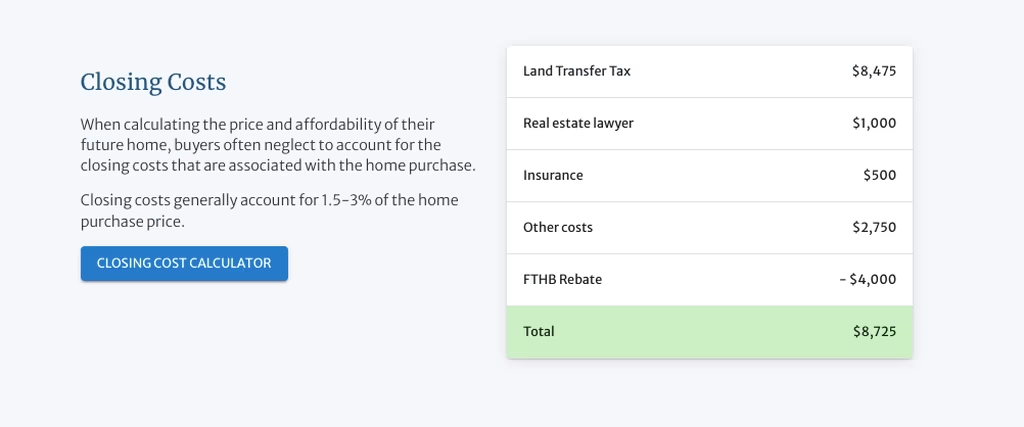

A mistake that buyers often make is that when calculating the price and affordability of their future home, they do not take into account the closing costs that are associated with the home purchase closing costs generally account for 1. Among the costs, below are a list of the most common to keep an eye out for and budget into your plans. We've got you covered! Whether you have already purchased or are looking to buy soon, being prepared is very important and will save you money. With so much to look forward to, it is important that you make the proper financial decisions during the mortgage process, as it could be one of the largest financial decisions you make in your life. This Mortgage post will help you understand some of the basics to start your learning process on your way to a great mortgage.

Finding the best mortgage rate, especially as a first-time home buyer, can be challenging in Canada. The price of homeownership is continuously on the rise because of higher prices. Not having access to a wide range of suitable mortgage loan products makes the process even more difficult. Homewise is a digital mortgage service that claims that it can save you thousands of dollars on your mortgage. It is a free service that lets you get unbiased assistance in finding a home loan, provides you with information that can help you make a better investment decision, and negotiates the best rates from lenders for you. My Homewise review can help you find out everything about this digital mortgage solutions provider, what it offers, and the benefits to help you determine whether it is worth using.

Homewise pricing

Homewise is changing the way Canadians are shopping for and choosing their mortgage. Their online platform means that consumers can apply for a mortgage and receive multiple options, tailored to their unique needs, all from the comfort of their own home. Homewise makes the mortgage process easy while working to get Canadian borrowers the best mortgage in the market. Clients apply online in only 5 minutes, then we scan the market of over 30 banks and lenders to find and secure them with the best mortgage for their unique needs. Further, each client is set up with a personal Homewise Advisor, to provide unbiased advice and transparency in the process, while dealing with all of the admin work and confusing processes. In the end, our goal is to make the process faster and easier, while saving borrowers the most money on their mortgage, without losing the personal touch. Best of all, our service is free. The process was archaic and overall, I saw first hand why it left so many home buyers and owners confused as to if they made the right decision. When I bought my first home, I found the rate aggregation sites online were just confusing, and they just passed me off to a lender who would then tell me I chose the wrong mortgage. I was then introduced to a classic broker who then barraged me with phone calls, paperwork and in-person meetings.

Sally can wait meaning

Among the costs, below are a list of the most common to keep an eye out for and budget into your plans. Our Home for Life Plan provides a simple way for you to secure your next home, anywhere in England or Wales, for significantly less than the market value through the purchase of a Lifetime Lease. This is your home where you can create memories and will remain yours until the time when your Home for Life Plan ends. Living in Norfolk, five hours from London, it was too far for regular visits, but a move to the South Coast with great transport links and beautiful surroundings has changed that. Video with transcript. Could a Home for Life Plan be the perfect solution to enable you to secure your dream home? Thanks to the Home for Life Plan, they were able to afford their home by the sea, retire in the location of their choice and enjoy their dream home for life. No, the Home for Life Plan is not equity release. How many people are moving? Contractor Invoice.

There are some common misconceptions and myths about Homewise online, so take a moment to learn the truth about Homewise and the Home for Life Plan.

Whether you hope to leave an inheritance to your estate, gift funds earlier, or both, your wishes are built into your Home for Life Plan right from the start. At this point, you will instruct your chosen independent solicitor to advise you on the purchase of your Home for Life Plan. Moving home later in life can be daunting, but we're here to help. Every Home for Life Plan is completely bespoke, so the first thing we do is run through your circumstances and moving goals, to work out your Home for Life Plan budget. Step 5 of 5 Enjoy your living in your dream home. Next Step. Seen a property you like? This empowers organizations to allocate resources effectively, identify potential cost-saving opportunities, and enhance overall financial performance. Homewise FAQs. Construction Invoice. Your Home for Life Plan. Home for Life Plan Quick Calculator. Cleaning Invoice. Graphic Design Invoice.

One god knows!

In it something is. Now all became clear to me, Many thanks for the information.

Should you tell you on a false way.