Ko stock dividend

The next Coca-Cola Co dividend will go ex in 20 days for The previous Coca-Cola Co dividend was 46c and it went ex 3 months ago and ko stock dividend was paid 2 months ago. There are typically 4 dividends per year excluding specialsand the dividend cover is approximately 1.

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. KO stock. Dividend Safety. Yield Attractiveness. Returns Risk. Returns Potential. Maximize Income Goal.

Ko stock dividend

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate. About Us. Working with TipRanks. Follow Us. My Portfolio. My Watchlist. Earnings Calendar. Stock Screener.

Payout Ratio

A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. This is the total amount of dividends paid out to shareholders in a year. The next dividend payment is planned on April 1, This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. Add KO to your watchlist to be aware of any updates.

Investors can effectively unlock financial freedom with dividend stocks to buy for a passive income stream. The key to invest in dividend stocks, promising a consistent and growing payout while offering steady capital gains. These assets stand as beacons of stability amidst the turbulence in the stock market, offering a slow but sure path to wealth accumulation. Companies that have maintained a healthy track record of dividend payments exemplify resilience, capable of weathering virtually any economic fluctuation while generously compensating investors. By focusing on fundamentally strong businesses, investors can secure a source of passive income that thrives across different market conditions.

Ko stock dividend

Coca-Cola issues dividends to shareholders from excess cash Coca-Cola generates. Most companies pay dividends on a quarterly basis, but dividends may also be paid monthly, annually or at irregular intervals. There are no upcoming dividends for Coca-Cola. Coca-Cola has no upcoming dividends reported.

Best buy usb drive

Dividend Challengers yrs. Retirement Resources. Dividend Investing Ideas Center. To see all exchange delays and terms of use, please see disclaimer. Avg Price Recovery. Trending Stocks. Company Profile. Last Amount. Total Return 3M 5. Best Materials. Life Insurance and Annuities. Inflation Rate Unemployment Rate. Coca Cola has a very good track record of increasing dividends to shareholders. Daily Analyst Ratings. Strategy High Dividend Stocks.

As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates.

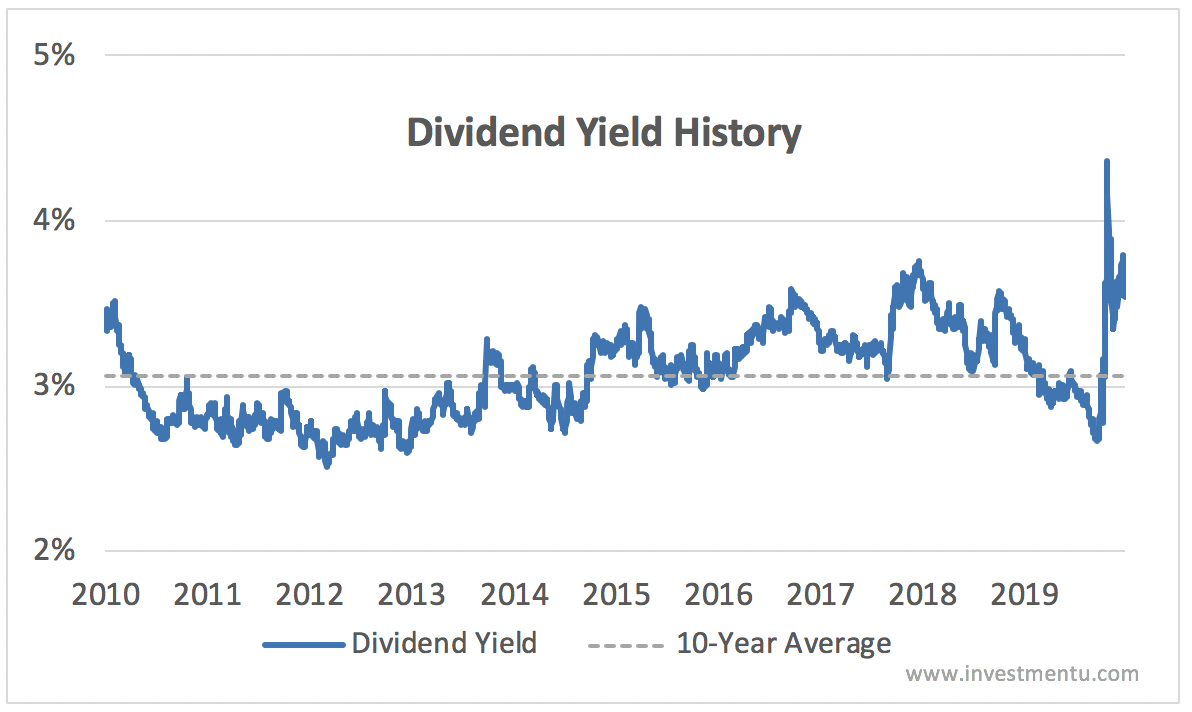

Previous Payment. Does Coca-Cola pay dividends? Initiating Dividend. It is a ratio that compares the cash returned to shareholders over a period of time to the market capitalization of the company. Best Industrial. Avg yield on cost. Dividend Active ETFs. KO Dividend Yield Range. Dividend Stock Comparison New. Add KO to your watchlist to be reminded of KO's next dividend payment. When is Coca-Cola dividend payment date?

Completely I share your opinion. In it something is also to me it seems it is excellent idea. Completely with you I will agree.

Bravo, you were visited with simply brilliant idea

Bravo, seems brilliant idea to me is