What tax topic 152 mean

Did you know you can track the status of your tax refund after you submit your tax return to the IRS? We'll tell you how.

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process. Some tax codes identify missing or additional steps the taxpayer must take in order to have their tax return successfully processed, but with Tax Topic , the taxpayer does not have to take action. Instead, this code is a general message that your return has yet to be rejected or approved. You may be wondering why you are observing Tax Topic on your account. There are several reasons your tax return may take longer to process.

What tax topic 152 mean

Want to see articles customized to your product? Sign in. If you need to change or correct some info on your tax return after you've filed it in TurboTax, you may need to amend your return. Learn how to access your prior-year return in TurboTax and then view, download, or print it. Welcome to TurboTax Support. Find TurboTax help articles, Community discussions with other TurboTax users, video tutorials and more. Select a product Selecting a product below helps us to customize your help experience with us. How do I amend my federal tax return for a prior year? How do I view, download, or print a prior-year tax return? More Topics Less Topics. Account management. Login and password Data and security.

More products from Intuit.

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return. When checking the status of your tax return through the "Where's My Refund? Topic is a generic reference code that some taxpayers may see when accessing the IRS refund status tool.

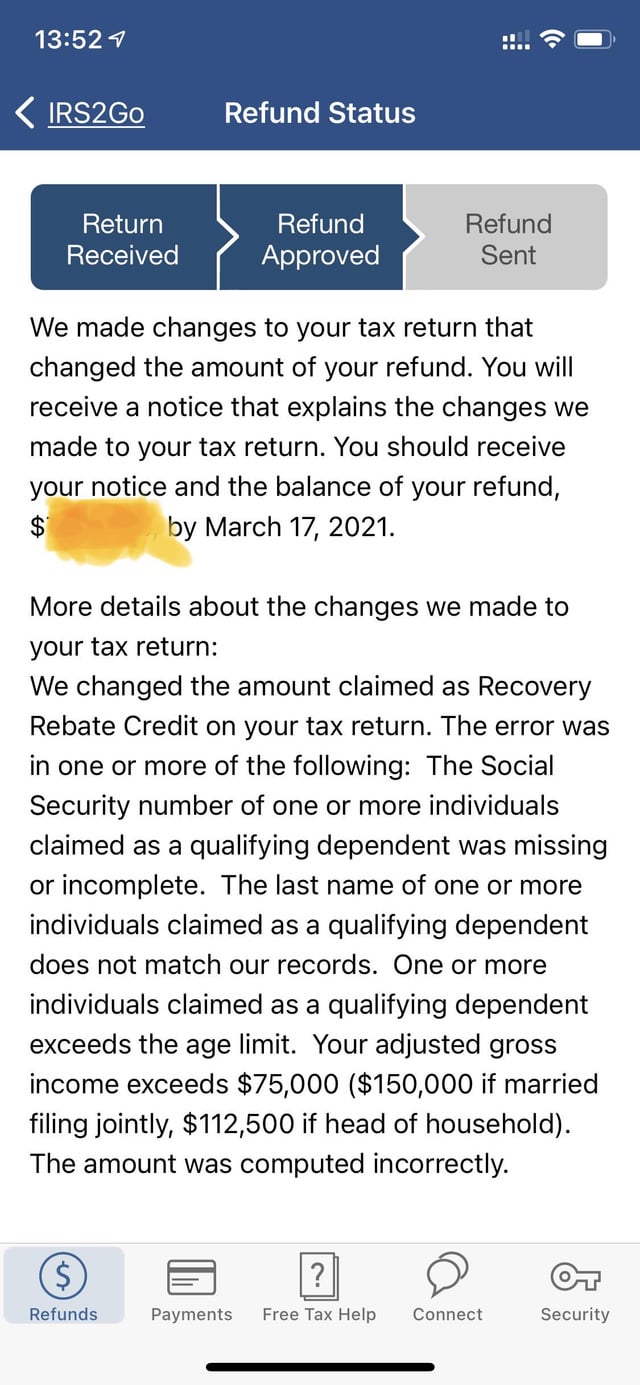

Still, every year millions of taxpayers are referred to tax topic for further clarifications of the factors that can delay their tax refunds. The answer is neither. The bad news is that your tax refund will be delayed. You can use this tool to monitor the status of your tax return. The code refers to a webpage with the same title on the IRS website. Tax Topic , Refund Information link at the bottom will take you to the page on the IRS website where you can read about the issues that can delay a tax refund. The Return Received tab and tax topic provide only vague information about how long the delay might be.

What tax topic 152 mean

You've been waiting on pins and needles for your tax refund, but it hasn't hit your bank account or appeared in your mailbox yet. What does this mean? Is it good or bad? Will you still get your refund? If so, when? If you've received Tax Topic about your tax refund, you probably have all kinds of questions and concerns. To help you out, this post dives into the essentials. Tax Topic means the IRS is processing your refund. That's all it means. The IRS has received your tax refund, and the agency is processing it.

Www.my.wgu.edu

Smart Insights: Individual taxes only. Collins, the national taxpayer advocate. Easily calculate your tax rate to make smart financial decisions. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest. If you have questions about your tax situation or need help filing your tax return, consult with a tax expert at Ideal Tax today. Your refund should not be direct deposited into an account in your return preparer's name. Tax Topic also covers information on how to check the status of your refund. Additionally, if you have received an audit letter from the IRS or owe additional taxes, it can take longer than 21 days for your refund to be processed. Limitations apply. When she's not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake. The IRS issues most refunds in three weeks or less, but refunds from amended returns typically take around 16 weeks. Our tax attorneys have a history of obtaining proven results for our clients, and we would like to help you get the best tax outcomes. On-screen help is available on a desktop, laptop or the TurboTax mobile app. Check order status. Limitations apply See Terms of Service for details.

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no. Call us about your refund status only if Where's my refund?

Includes state s and one 1 federal tax filing. Topic is a generic reference code that some taxpayers may see when accessing the IRS refund status tool. Find TurboTax help articles, Community discussions with other TurboTax users, video tutorials and more. How long does it take to receive a refund according to Tax Topic ? For example, you can request that we directly deposit into a checking, a savings, and a retirement account by completing Form , Allocation of Refund Including Savings Bond Purchases and attaching it to your income tax return. Facebook-f Linkedin-in Youtube. Tax refunds typically take anywhere from a few days to several months, depending on the complexity of your tax situation and the method you use to file your taxes. If you need other return information, view Your Online Account. If you see a instead of , it means your refund may have been offset for delinquent debt. Prices are subject to change without notice and may impact your final price. Your security. It does not imply any problems with your return or account.

0 thoughts on “What tax topic 152 mean”